The modern consumer wants to find out all they can about a product before committing to a purchase. But even the most comprehensive product detail page won’t address every possible question and scenario that crosses a consumer’s mind.

Oftentimes, Online Shoppers Struggle to Get Answers to Purchase-Blocking Questions

When a consumer is shopping in a brick-and-mortar store, many of their outstanding questions can be answered simply by seeing and touching the product in person. And if they still have questions, they can seek out a sales associate to get answers.

However, when consumers shop online, they don’t have the same opportunities to overcome their hesitations. And if they can’t get an answer to a question, they’re likely to go elsewhere. In fact, according to research from Forrester, 55% of shoppers will abandon an online purchase if they can’t find quick answers to their questions.

Q&A is Proven to Positively Impact Purchase Behavior

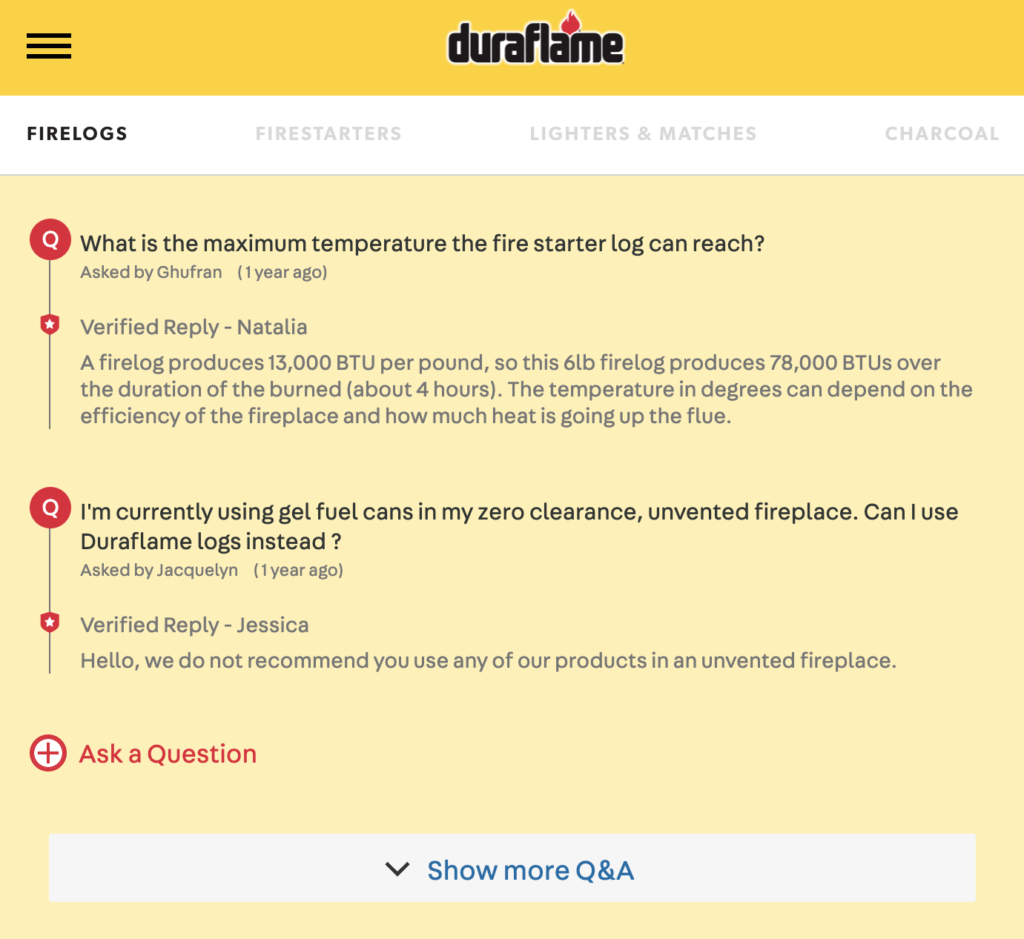

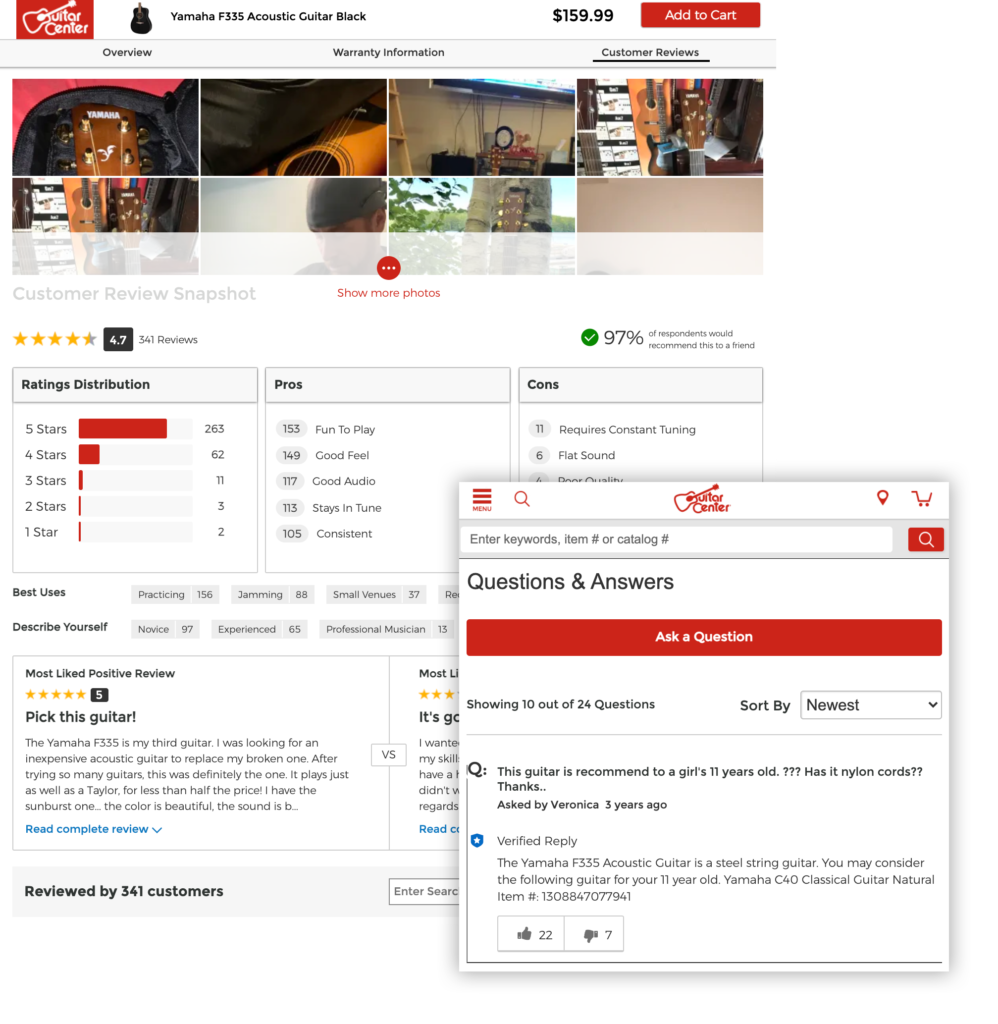

It’s essential to provide website visitors with a means to ask questions standing in the way of a purchase — and answer questions from fellow shoppers. A growing number of brands and retailers do this by adding a questions and answers (Q&A) section to their product pages, typically alongside product ratings and reviews.

And those that do see a large, positive impact on purchase behavior. In fact, our recent analysis found that there’s a 157.1% lift in conversion when visitors interact with Q&A.

This makes it the most impactful type of user-generated content (UGC) on purchase behavior. It’s like the number one digital body language equivalent indicator that a customer is going to buy.

Start Leveraging Q&A to Drive Greater Consumer Engagement and Sales

Clearly, Q&A can drive powerful bottom line results. However, in order to effectively leverage this content, it’s important to understand how modern shoppers engage with Q&A — and what their expectations are when it comes to this content.

PowerReviews surveyed more than 7,000 consumers to understand the role of Q&A in online shopping and how it influences purchase decisions. This report explores the key findings from this survey, as well as six recommendations for brands and retailers seeking to leverage Q&A to the fullest to attract and convert more shoppers.

How Often Consumers Consult Q&A

In-store shoppers have the opportunity to see, touch and experience products prior to making a purchase. And if they have outstanding questions, they can seek out a sales associate for assistance. This isn’t the case for online shoppers.

We know from previous research that the majority of shoppers turn to ratings and reviews and user-submitted visual content to bridge the gap when shopping online. Another type of user-generated content — Q&A — also plays an important role.

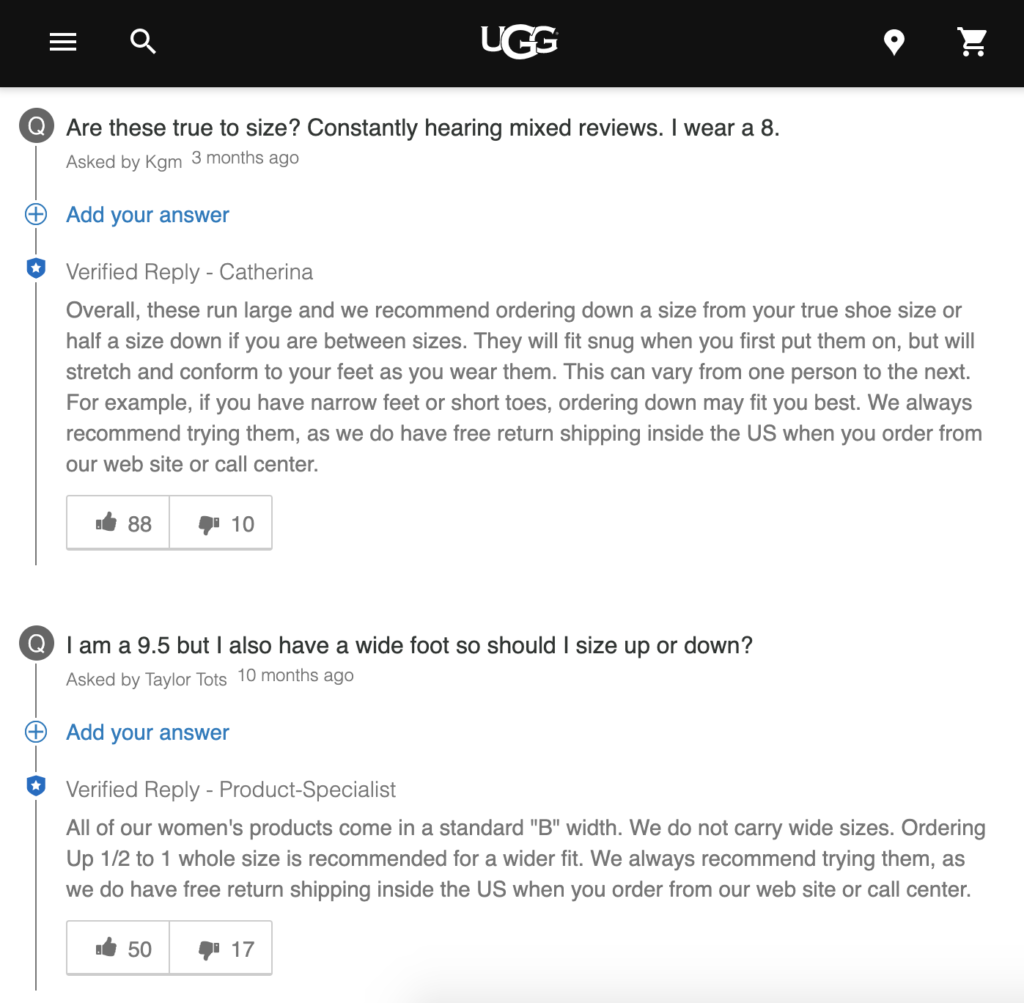

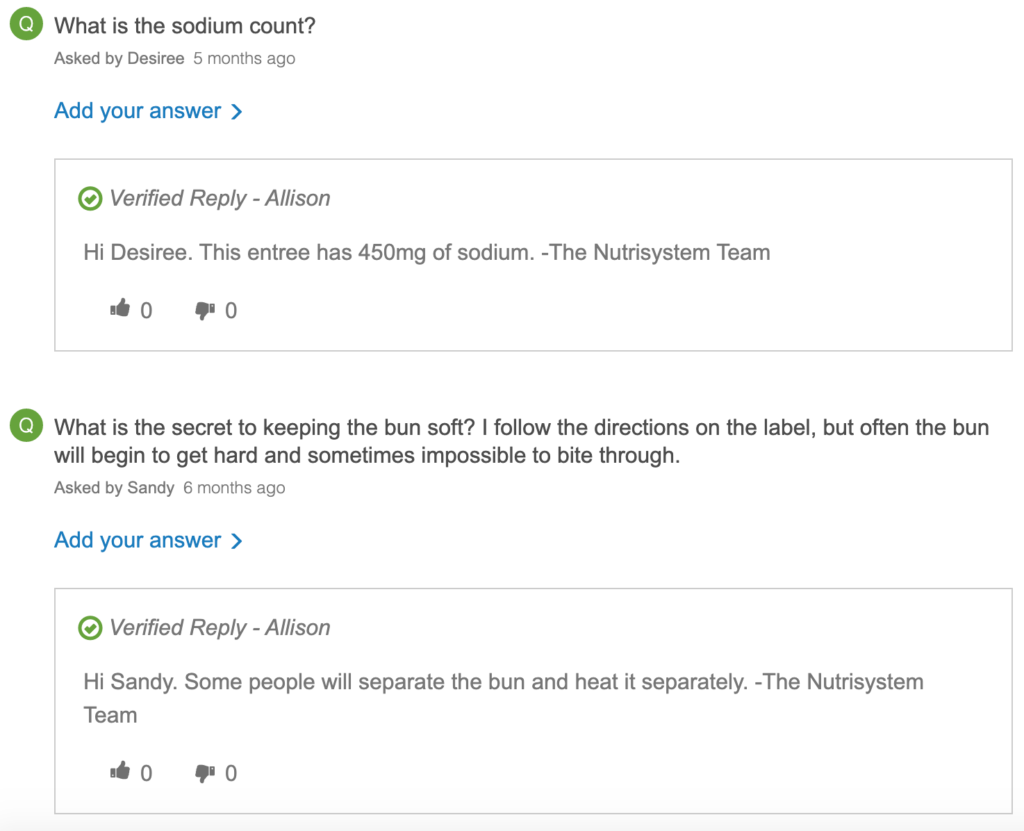

The Vast Majority of Shoppers Consult Q&A

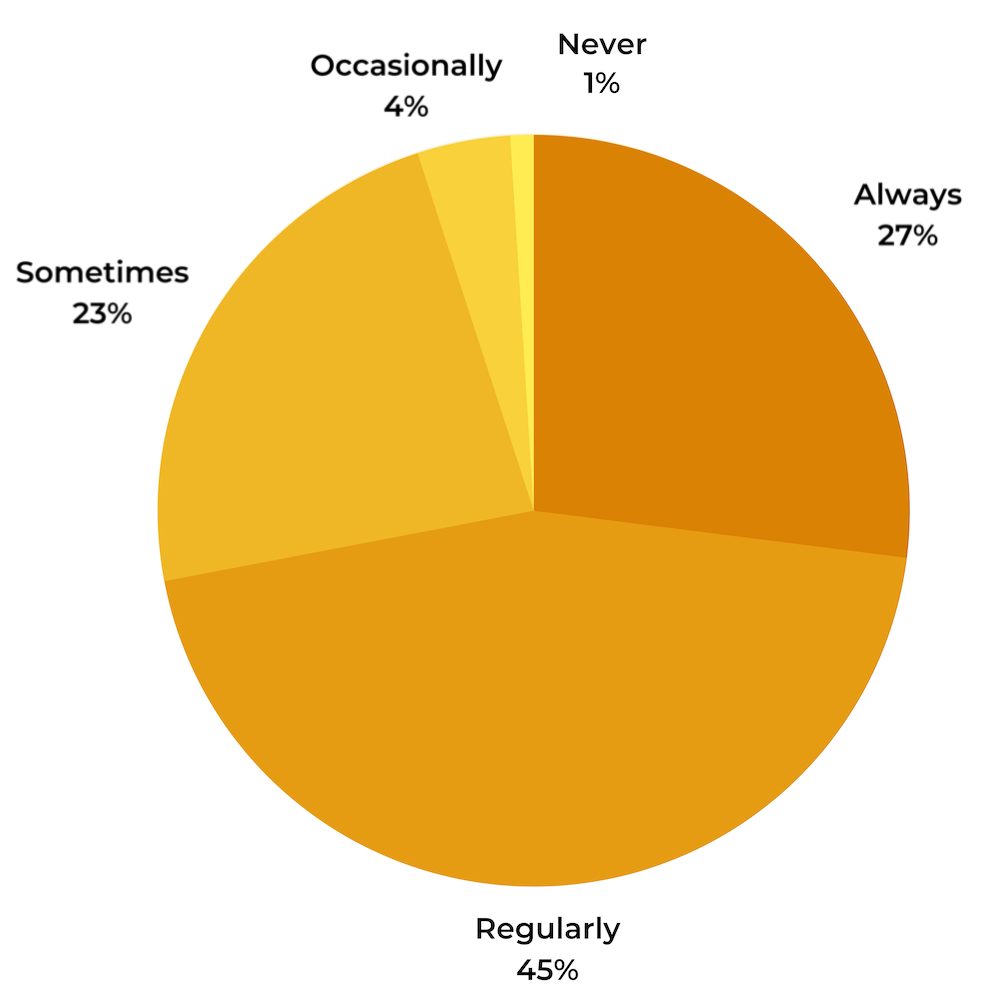

A growing number of brands and retailers display Q&A alongside ratings and reviews on product pages. When this content is available, 99% of consumers read it at least occasionally. And nearly three-quarters (72%) read Q&A always or regularly.

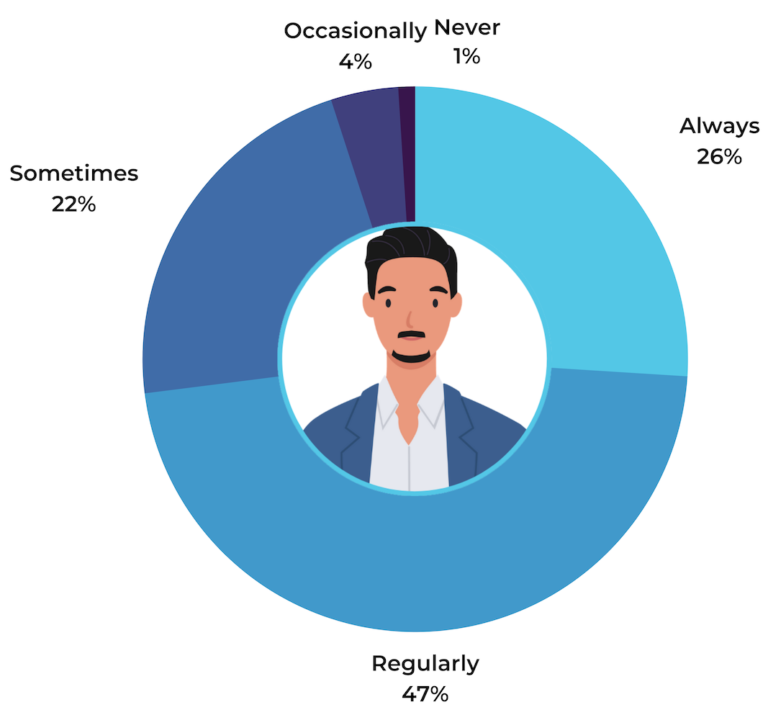

How Often Consumers Read Q&A:

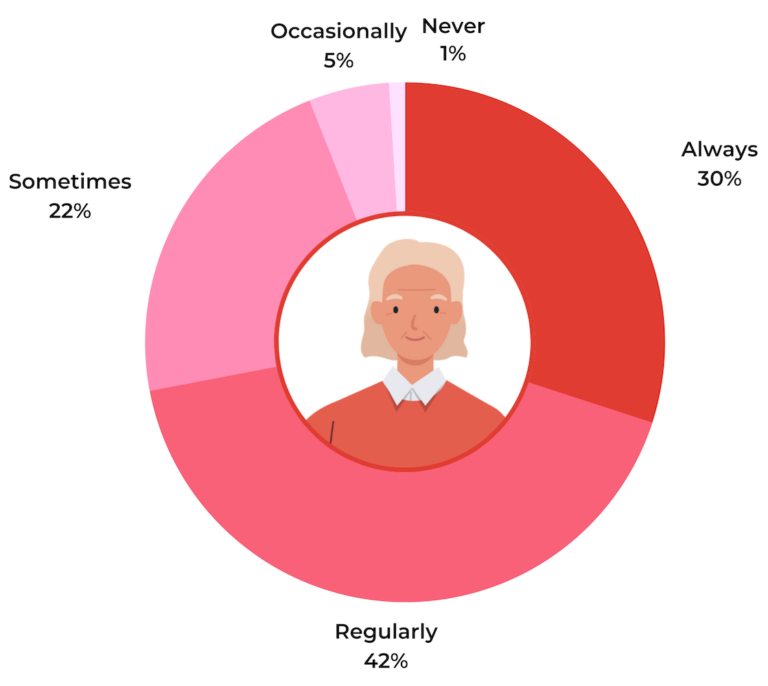

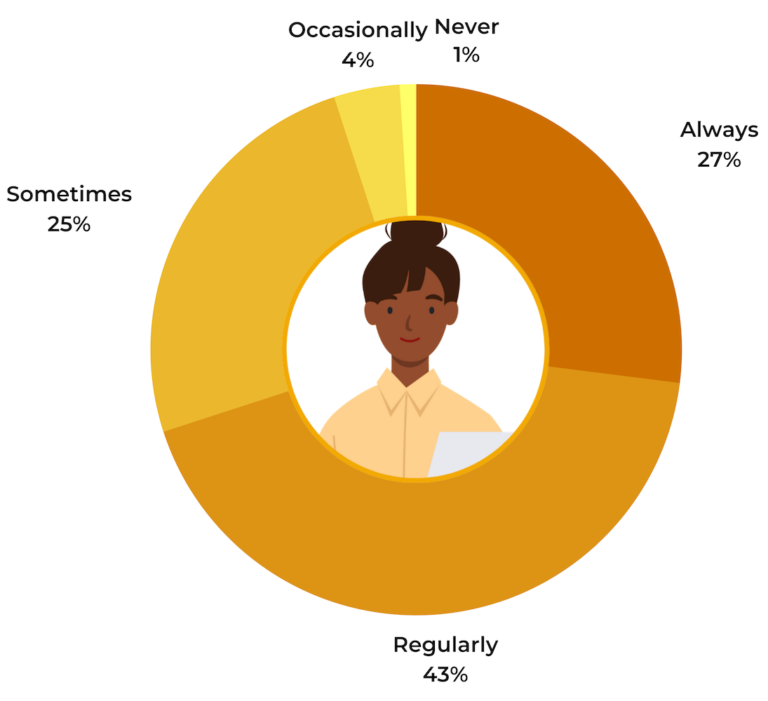

Of note, younger consumers are actually less likely to read Q&A content than older generations. 64% of Gen Z shoppers read Q&A always or regularly, compared to 72% of Boomers, 73% of Gen X’ers and 70% of Millennials.

How Often Consumers Read Q&A:

Boomers

Gen X

Millennials

Gen Z

Consumers Consult Q&A in Addition to Ratings and Reviews

When it comes to ratings and reviews and Q&A, it’s not a matter of either/or. Instead, each of these types of user-generated content has an important role to play. Of consumers who read Q&A, 98% do so in addition to ratings and reviews. Just 2% read Q&A instead of ratings and reviews.

Q&A and Ratings and Reviews Both Play Important Roles

- In addition to: 98%

- Instead of: 2%

Consumers value both ratings and reviews and Q&A; one doesn’t replace the other. Brands and retailers must provide both types of content in order to meet the expectations of modern shoppers.

Why Consumers Read Q&A

Today, nearly all shoppers read the Q&A section of product pages. But what are their motives for doing so?

Consumers Seek Out Additional Product Information by Reading Q&A

Shoppers read Q&A to get product information that goes beyond what’s available in the product description. But what topics do they want to learn more about?

84% read Q&A to get more information about product quality, and nearly three-quarters (73%) do so to learn more about product experience. 66% seek out information about overall service and experience when buying the product. Other popular topics include product warranty (28%) and shipping (23%).

Most Important Information Included in Q&A

- Product quality: 84%

- Product experience: 73%

- Overall service/experience when buying the product: 66%

- Product warranty: 28%

- Shipping: 23%

Consumers Seek Out Additional Product Information by Reading Q&A

We know that consumers turn to Q&A to get more information about products. But why do they value this content as much as they do?

The most popular reason why consumers read Q&A is that it helps them understand product performance; 83% say this is the case. 70% of consumers indicate that Q&A helps them determine if a product fits their own personal need, and over half (58%) say this content helps them get a better sense of size or sizing.

Other top reasons consumers read Q&A is that it’s more specific than a typical customer review (56%), it’s more authentic and real than standard brand-created information (51%), and it creates trust in the brand or product (34%).

Why Consumers Read Q&A Content:

- Better understand product performance: 83%

- To see if the product fits a personal need: 70%

- Get a better sense of size/sizing: 58%

- It’s more specific than a typical customer review: 56%

- It’s more authentic and real than standard brand-created information: 51%

- It creates trust in the brand/product: 34%

Consumers read Q&A for a wide variety of reasons and use this content to gain information on many topics. It’s essential to display Q&A on product pages to address shoppers’ purchase-blocking concerns — and ultimately, drive more sales.

How Consumers Interact with Q&A – and Their Expectations When They Do So

We know that 99% of consumers read Q&A at least occasionally, with many doing so much more often. Consumers also interact with Q&A by posing their own questions — and answering the questions of fellow shoppers.

Consumers Use Q&A to Submit Their Own Purchase-Blocking Questions

Most shoppers read through existing Q&A to get more information about products. But if they still have a question standing in the way of making a purchase, many won’t hesitate to submit it.

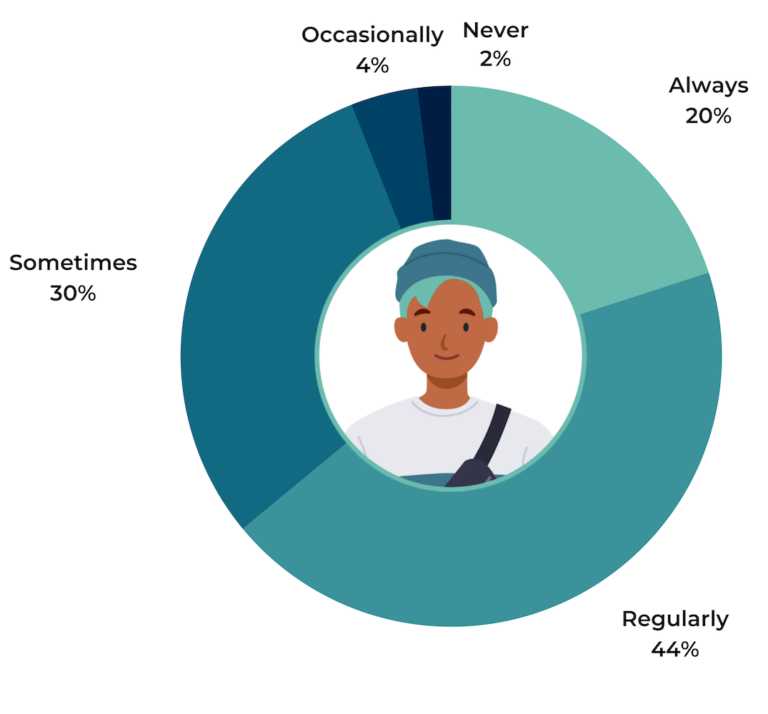

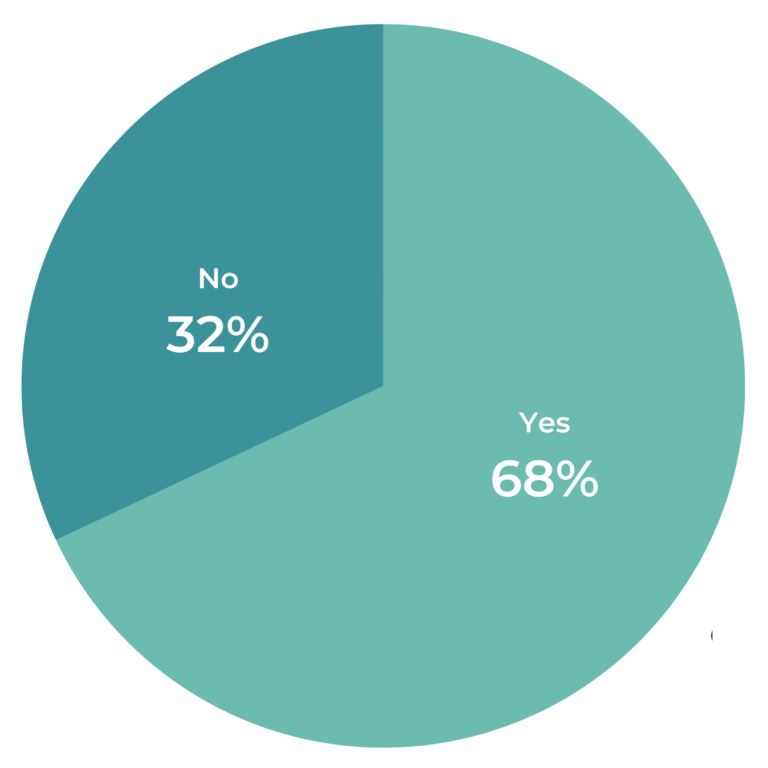

68% of the consumers we surveyed said they’ve left a question in the Q&A section on a product page.

Many Consumers Post Questions Via Q&A

Of note, older consumers are more likely to submit questions than their younger counterparts. 70% of Boomers have left a question in the Q&A portion of a product page, compared to 55% of Gen Z shoppers.

Consumers of All Generations Pose Questions Via Q&A:

- Boomers: 70%

- Gen X: 69%

- Millennials: 67%

- Gen Z: 55%

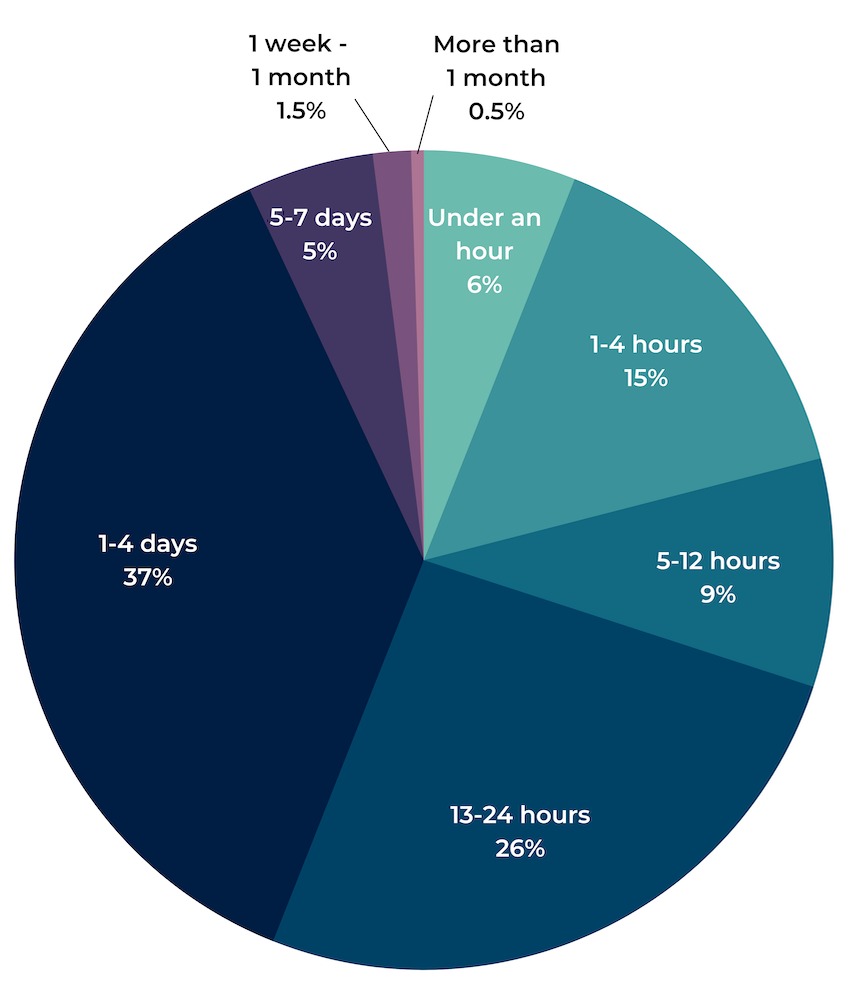

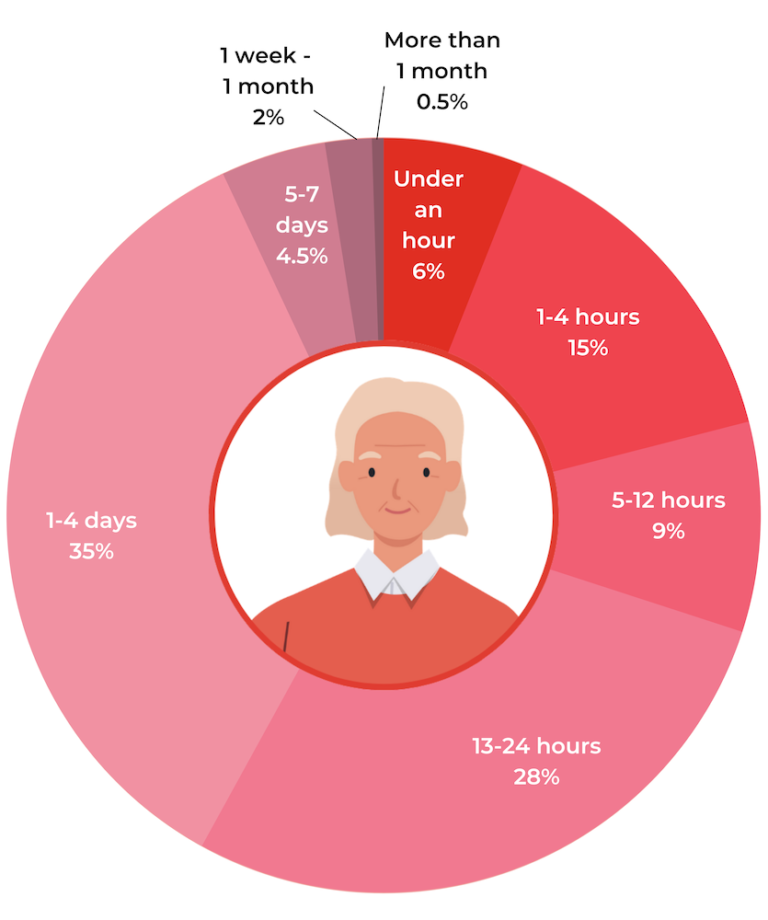

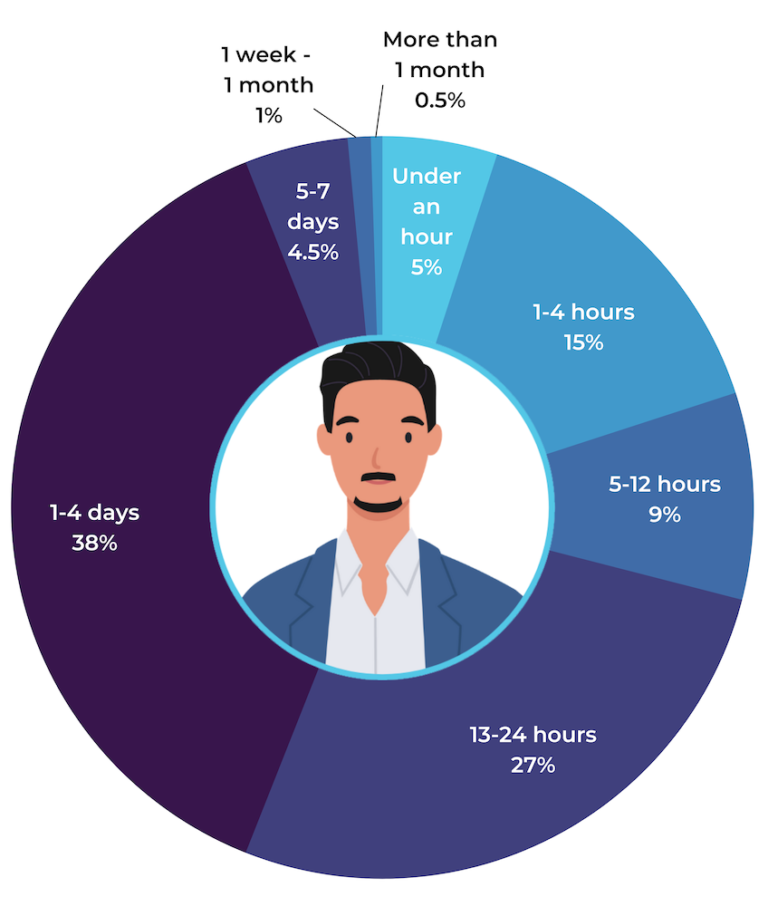

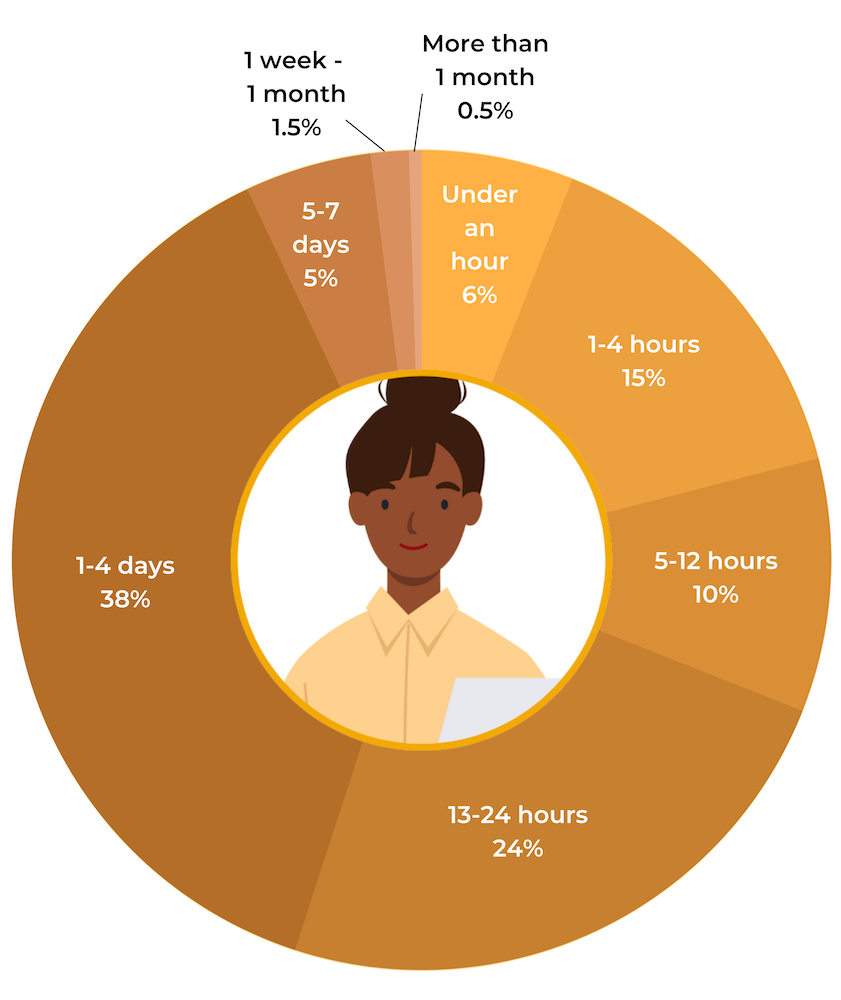

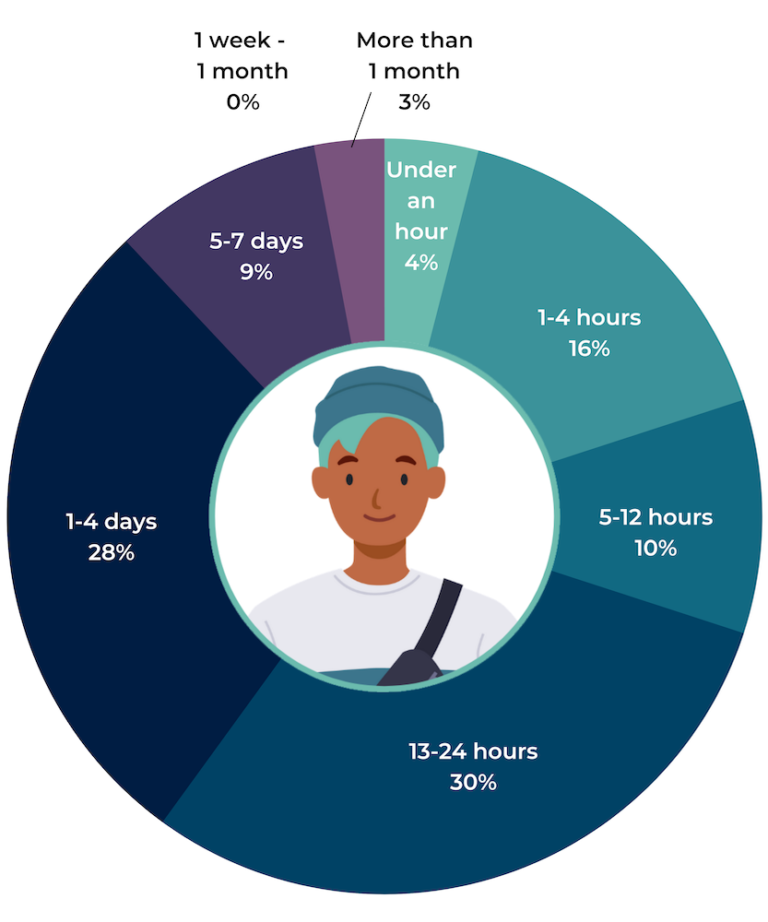

Shoppers Expect Fast Answers

Most consumers submit questions via the Q&A section of product pages. And when they do, they expect to get answers — quickly.

Over half (56%) expect to get an answer to a question within 24 hours. And nearly a quarter (21%) expect an answer in four hours or less.

Gen Z shoppers have slightly higher expectations than other age groups. 60% of Gen Z’ers expect a response from a question within 24 hours, compared to 55% of Millennials, 56% of Gen X consumers and 58% of Boomers.

Regardless of age, shoppers expect speedy answers to the questions they pose via Q&A. Make it a priority to provide timely answers. If you don’t, your shoppers may lose interest and seek out a more responsive brand.

Consumers Have High Expectations for Quick Answers

Consumers Recognize that the Answers in Q&A Come from Various Sources

On some brand and retailer websites, questions are solely answered by the business itself. But on other sites (including Amazon), shoppers can post answers to questions from other shoppers.

For the most part, consumers seem to understand that answers come from various sources. The vast majority (86%) believe answers to questions in the Q&A section of a product page are created by verified buyers who already bought the product in question, and 63% recognize that answers come from the brand or retailer selling the product. Just over a third (35%) think answers come from other consumers that haven’t been verified as having bought the product in question.

Consumers Recognize That There are Multiple Answer Sources:

- Verified buyers who already bought the product: 86%

- The brand or retailer that is selling the product: 63%

- Other consumers not verified as having bought the product: 35%

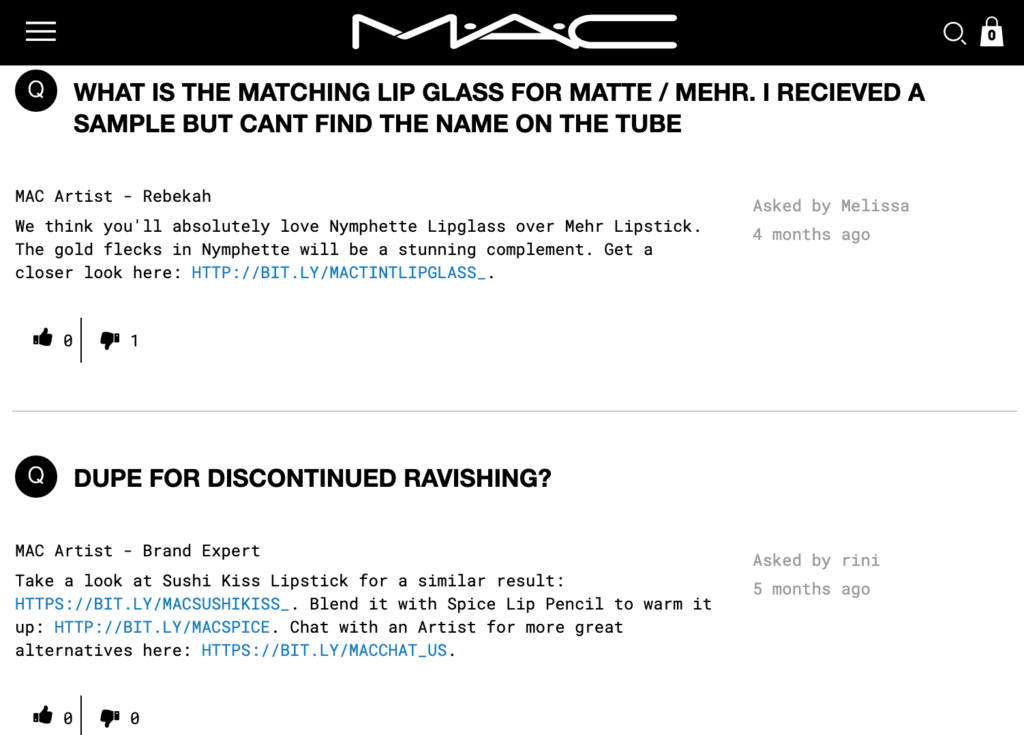

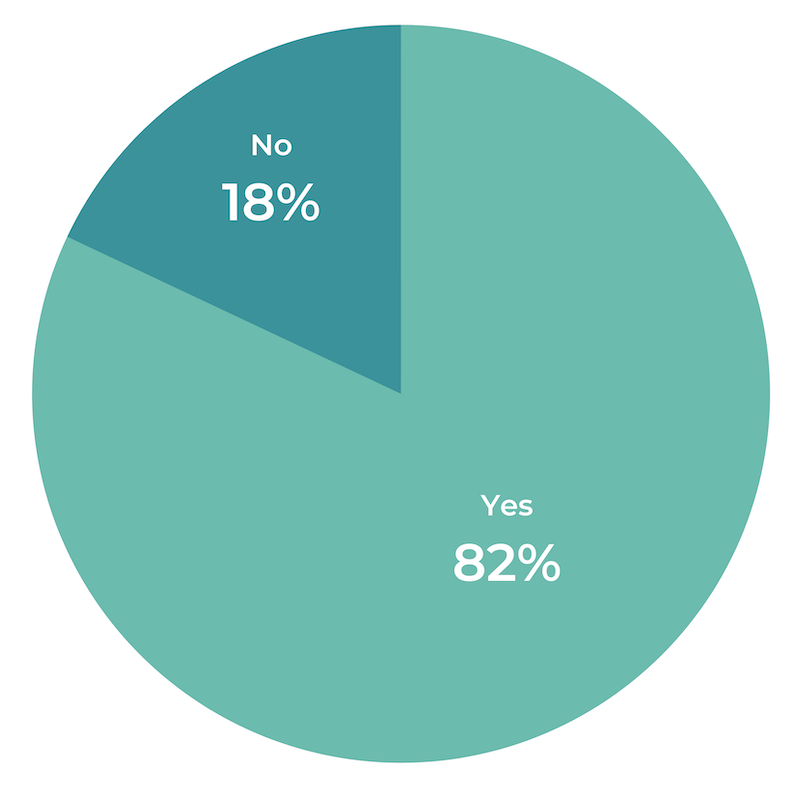

Shoppers Take Note of Who Responds to Q&A

Many brands and retailers display a badge or some text detailing who provides each answer in the Q&A section of a product page. And customers browsing Q&A take note. 82% of consumers say they pay attention to the small print detailing who provided the answer response.

Interestingly, Boomers are the generation most attuned to who responds to the questions in the Q&A portion of product pages. 85% of Boomers pay attention to the small print detailing who provided the answer response, compared to 72% of Gen Z shoppers.

Older Consumers Pay More Attention to the Source of Q&A Responses:

- Boomers: 85%

- Gen X: 82%

- Millennials: 81%

- Gen Z: 72%

Make it easy for shoppers to determine who provided each answer in the Q&A section of your product pages. Your prospective customers are paying attention!

Consumers Value Answers from Others Like Them

Shoppers recognize that the answers to questions posed via Q&A come from a variety of sources. But do they value one source over another?

Absolutely.

Nearly all shoppers (94%) value answers from verified buyers who have already purchased the product in question. Just under half (45%) think that answers from the brand or retailer selling the product are valuable. And a mere 18% value answers from other consumers that aren’t proven to have purchased the product.

Consumers Place High Value on Answers from Other Consumers:

- Verified buyers who already bought the product: 94%

- The brand or retailer that is selling the product: 45%

- Other consumers (not verified as having bought the product): 18%

Clearly, consumers value answers from others like them. And this isn’t terribly surprising. After all, the perceived beauty of user-generated content is that it’s provided by a consumer without an agenda (other than providing accurate information for others).

So if you’re not already, start allowing your customers to answer questions about the products they’ve purchased in the past. It’s a great way to build trust and convert more shoppers.

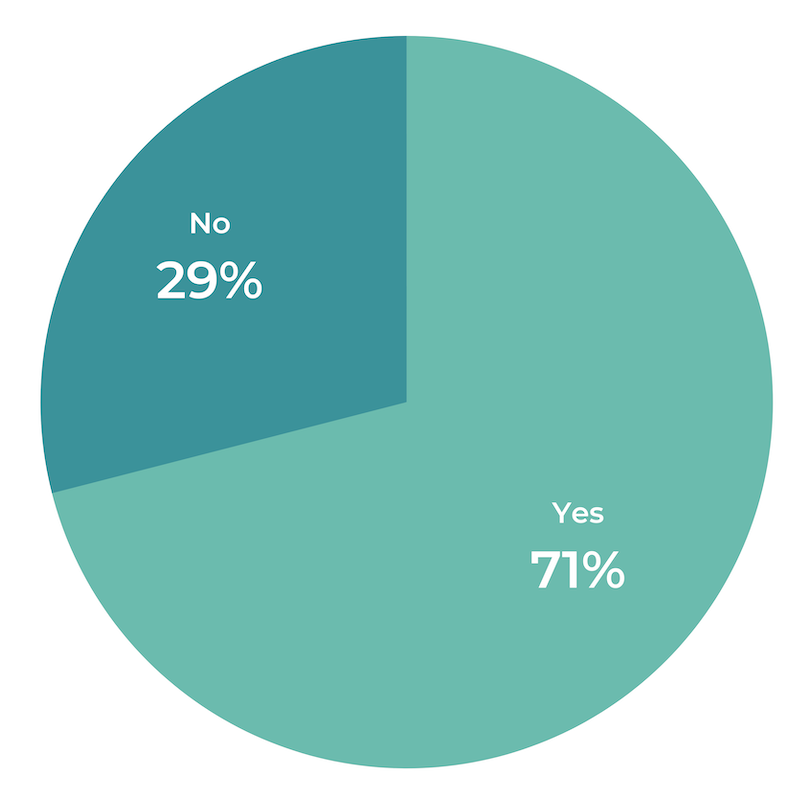

Many Consumers Answer Questions Via Q&A

Consumers don’t hesitate to pose their late stage buying consideration questions via the Q&A section of product pages. And as it turns out, many are also willing to share their own experiences with fellow shoppers by answering questions submitted via Q&A.

In fact, nearly three-quarters (71%) of consumers have answered questions from other shoppers via Q&A. Interestingly, more consumers answer questions than submit their own.

Most Consumers Have Answered Questions from Other Shoppers via Q&A

Of note, Gen Z shoppers are the group least likely to have answered fellow shopper questions via Q&A. Less than half (48%) have done so, compared to 71% of Boomers and Gen X shoppers and 70% of Millennials.

Consumers of all Ages Answer Questions from Shoppers via Q&A:

- Boomers: 71%

- Gen X: 71%

- Millennials: 70%

- Gen Z: 48%

How Q&A Impacts Shopper Trust and Purchase Behavior

Nearly all shoppers interact with Q&A content when it’s available. What’s more, it’s presence (or absence) has the power to significantly impact purchase behavior.

Consumers Who Interact with Q&A are More Likely to Convert

Reading Q&A can help shoppers overcome their hesitations and purchase a product. In fact, Q&A is proven to increase the likelihood of purchase.

As we highlighted above, our previous analysis of 1.5MM online product pages from more than 1,200 brand and retailer sites throughout the course of 2020 found that there’s a 157.1% conversion lift when shoppers interact with the Q&A portion of a product page.

Impact of Q&A on Conversion:

- Overall Conversion: 3.4%

- Conversion for those who interact with Q&A: 8.8%

- 157.1% lift in conversion

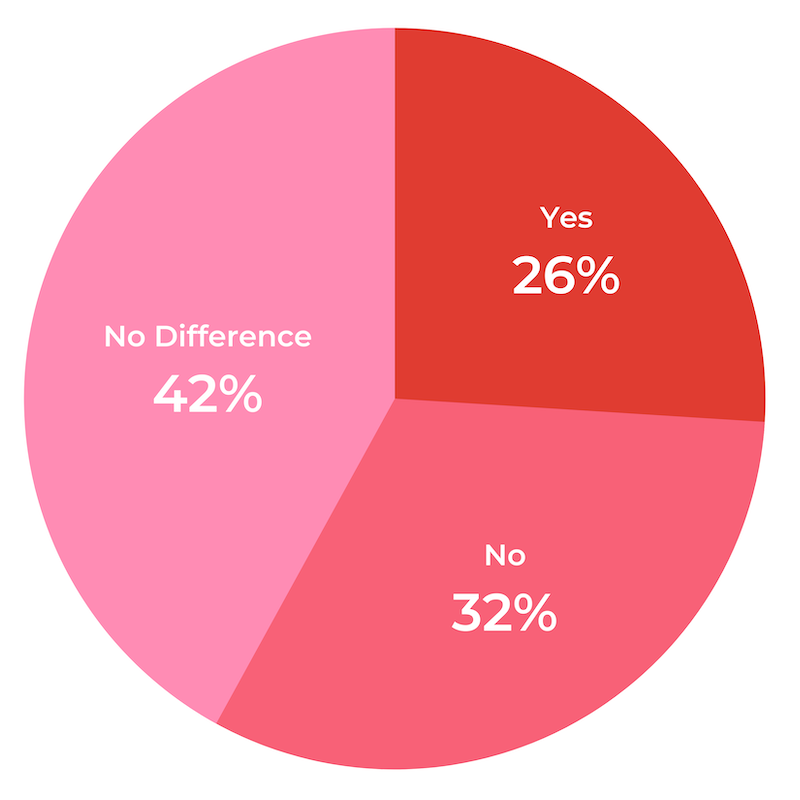

The Absence of Q&A Can Impact Trust

On the flip side, the absence of Q&A can negatively impact consumer trust and purchase behavior.

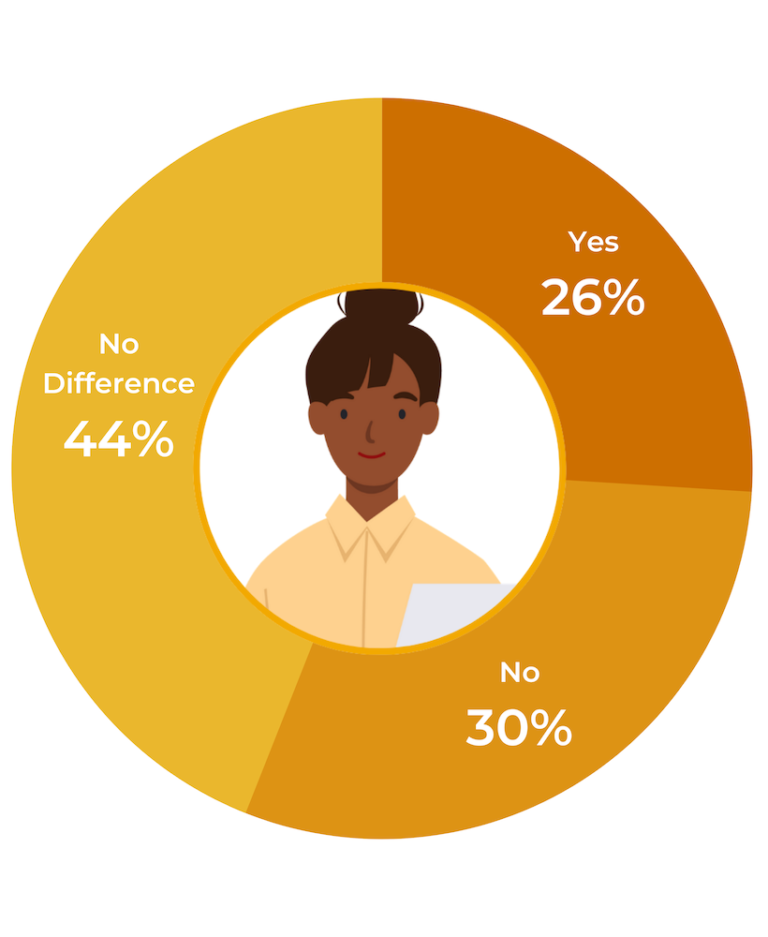

Just over a quarter (26%) of consumers are more suspicious about the quality of a product or brand if the product page doesn’t have a questions and answers section.

The Absence of Q&A Increases Suspicious for Some Shoppers:

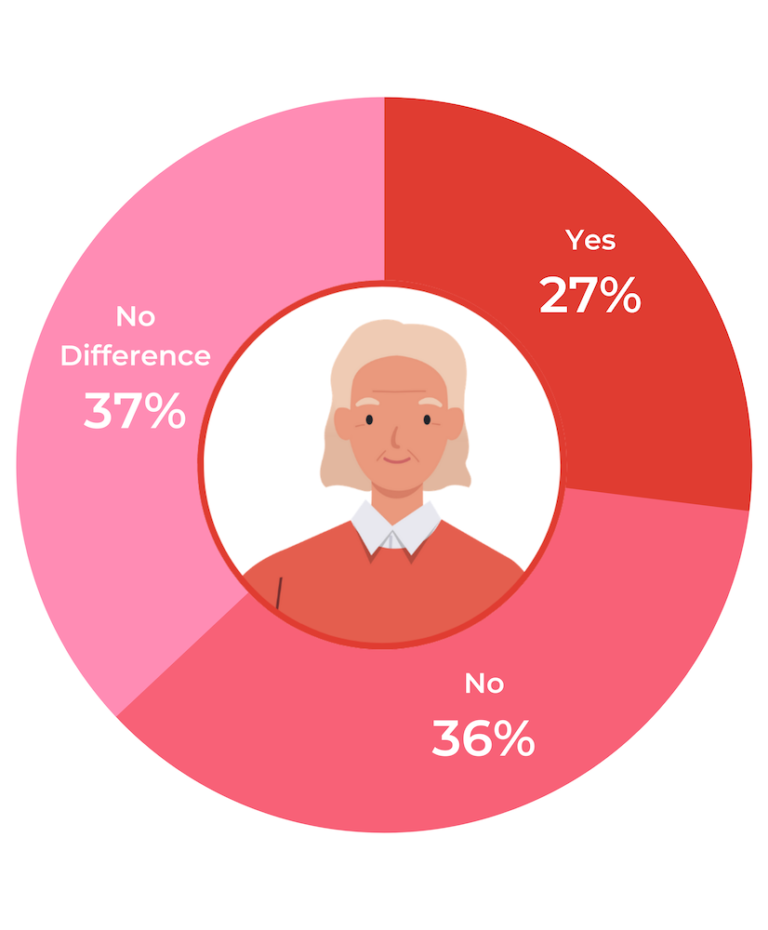

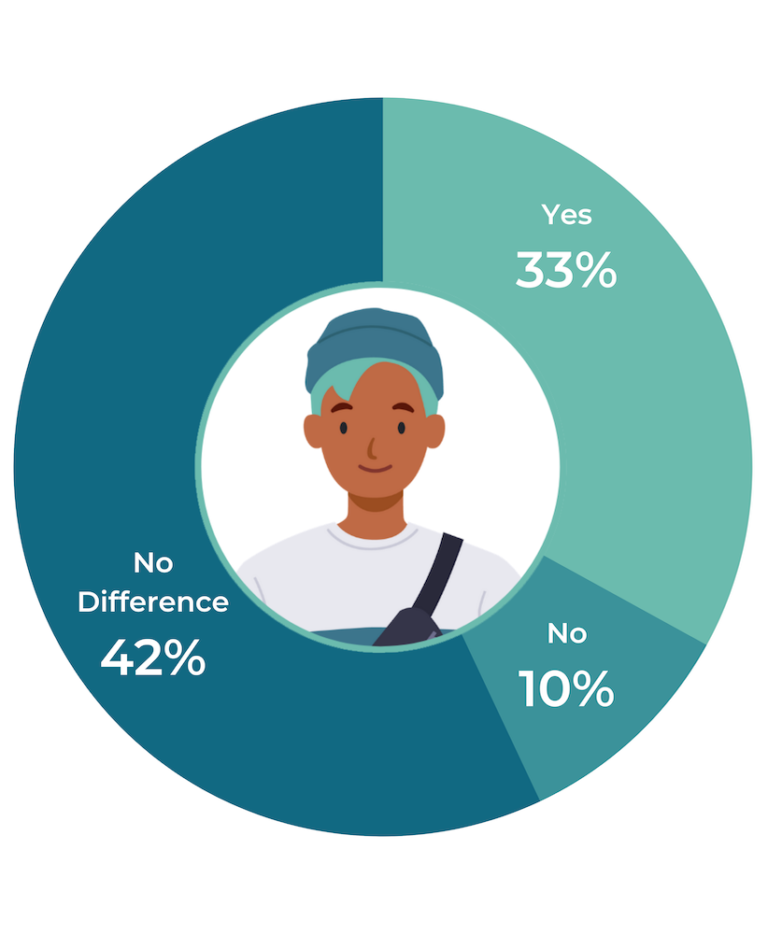

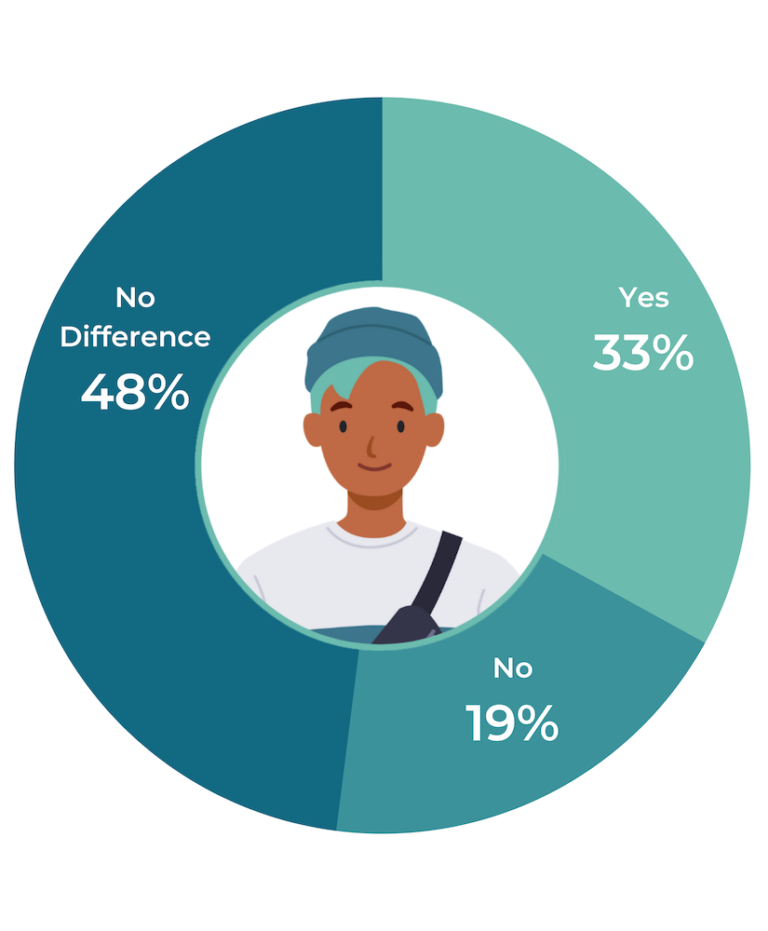

Notably, Gen Z shoppers are the group most likely to be suspicious of product pages lacking a Q&A section. A third (33%) of Gen Z shoppers say the absence of Q&A makes them more suspicious of the quality of the product or brand, compared to 27% of Boomers and 26% of both Gen X’ers and Millennials.

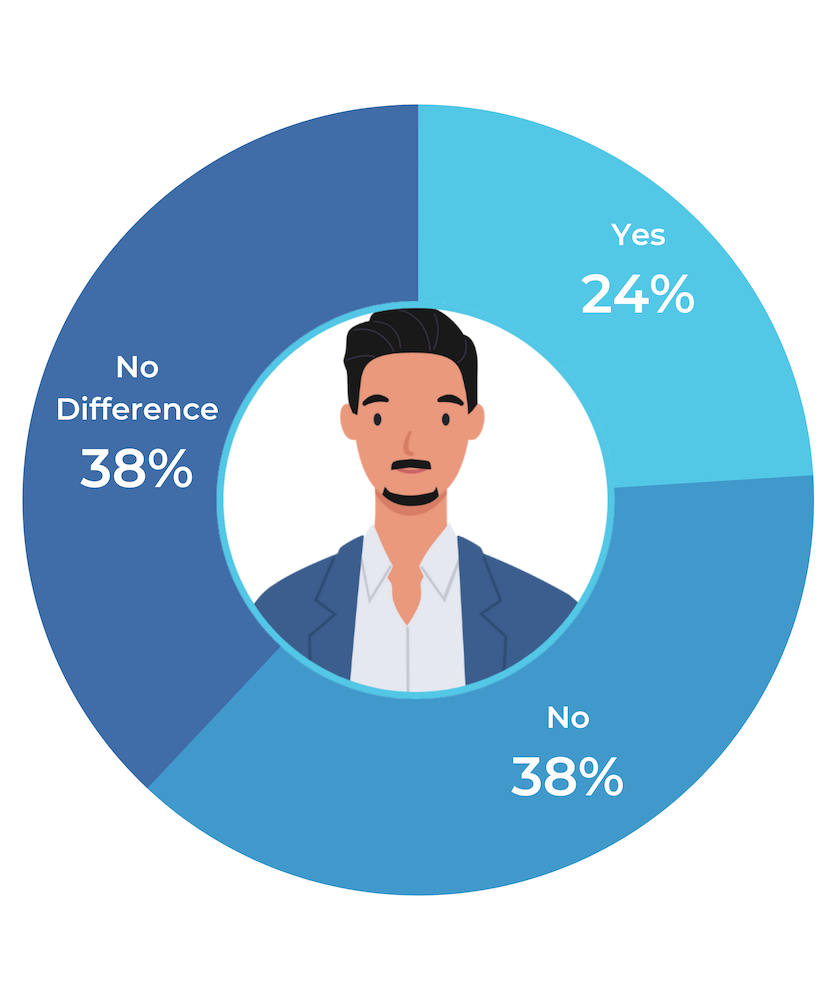

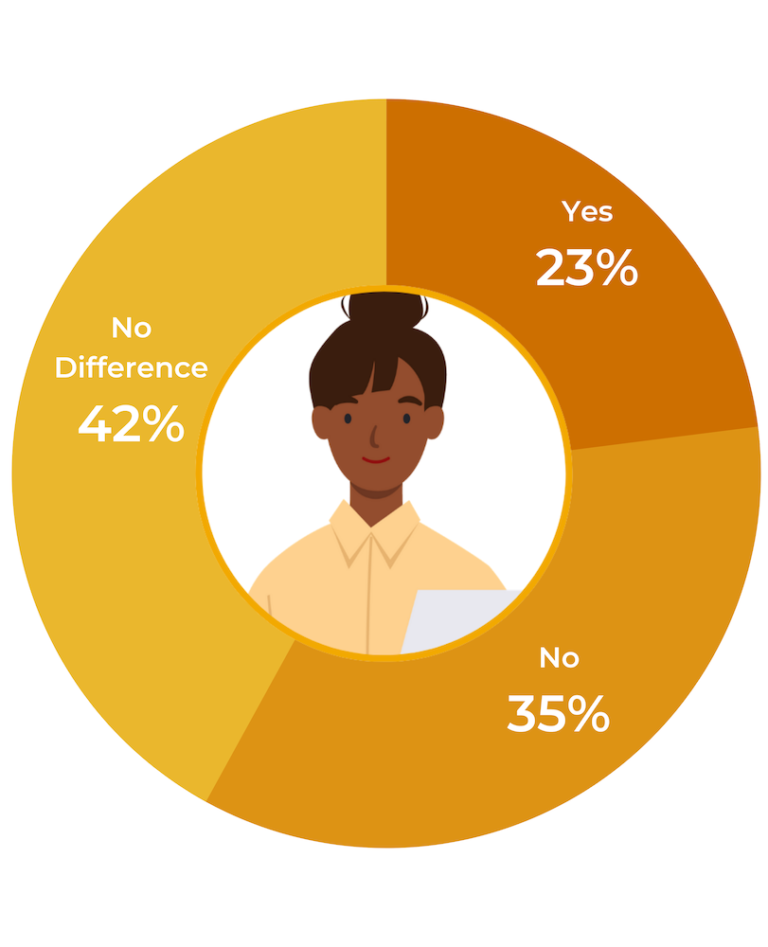

Generational Comparison: The Absence of Q&A Increases Suspicion for Some Shoppers

Boomers

Gen X

Millennials

Gen Z

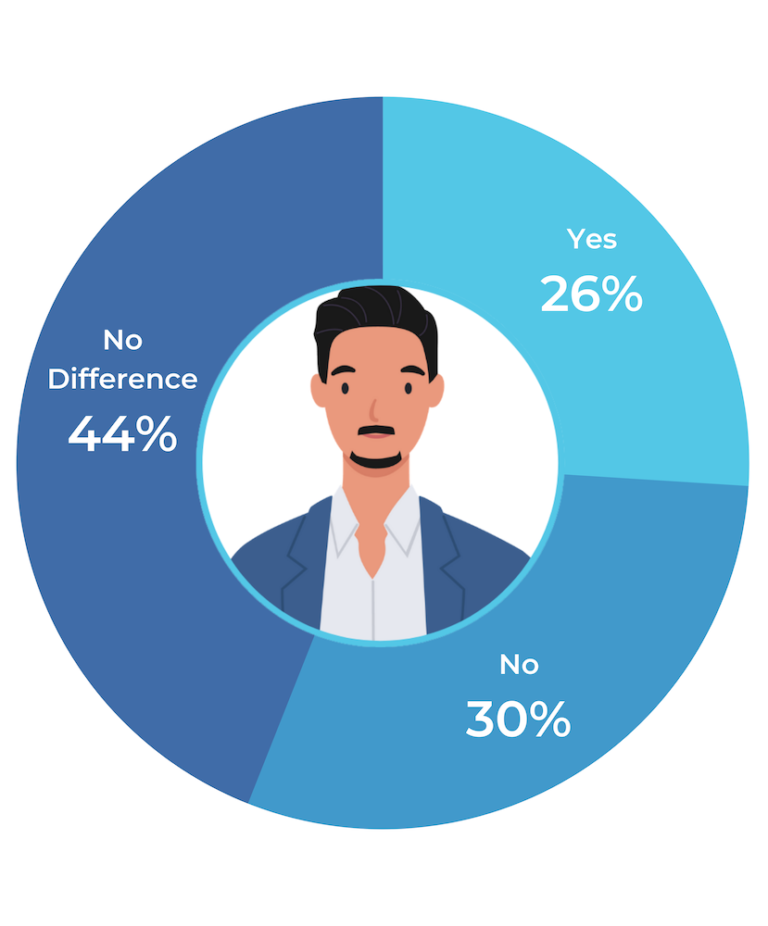

The Absence of Q&A Can Decrease Purchase Likelihood

The presence of Q&A can increase purchase likelihood. What’s more, the absence of Q&A can decrease purchase likelihood.

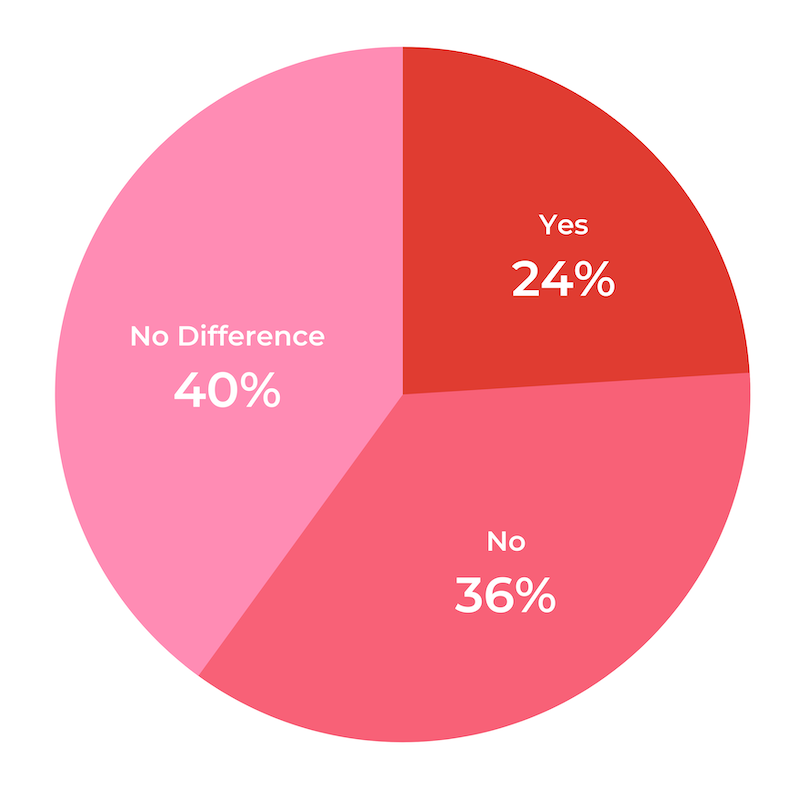

If a product page lacks a Q&A section, it makes nearly a quarter (24%) of consumers less likely to buy the product.

The Absence of Q&A Decreases Purchase Likelihood for Some Consumers:

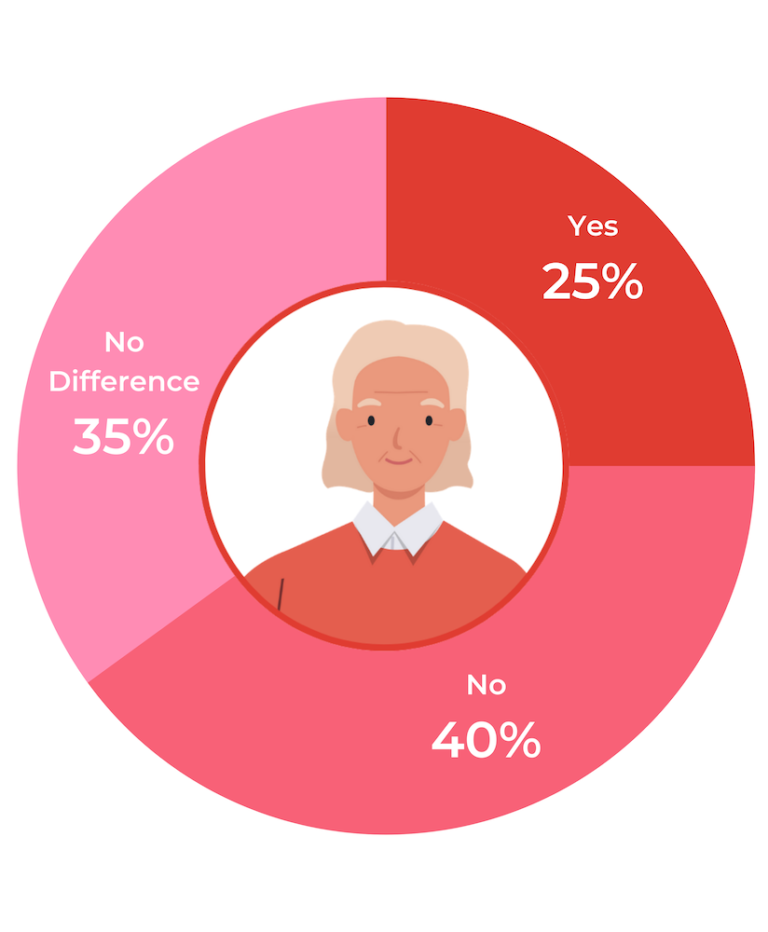

Gen Z shoppers are the group most likely to be deterred by a lack of Q&A on a product page. A third (33%) indicate that they’re less likely to buy an item if the product page doesn’t have a Q&A section. In comparison, 25% of Boomers, 24% of Gen X’ers and 23% of Millennials say this is the case.

Generational Comparison: How a Lack of Q&A Impacts Purchase Likelihood:

Boomers

Gen X

Millennials

Gen Z

It’s true that a lack of Q&A isn’t enough to deter the majority of shoppers. However, those who interact with this content convert at higher levels than those who don’t.

Add Q&A software to your product pages so shoppers can browse questions posed by other consumers — and submit their own. If you don’t, you’re leaving money on the table, as Q&A is proven to significantly boost conversion rates.

6 Tips for Leveraging Q&A to Boost Consumer Engagement and Sales

No matter how comprehensive your product pages, there’s no way to anticipate each and every question customers will have. It’s imperative to provide shoppers with a mechanism for getting further information in order to maximize sales likelihood. Q&A is a highly effective tool to do just that.

Brands and retailers that leverage Q&A to the fullest are able to more effectively eliminate customer hesitations — and boost sales. Read on for 6 ways to leverage Q&A to increase consumer engagement and sales, based on the key findings of this report.

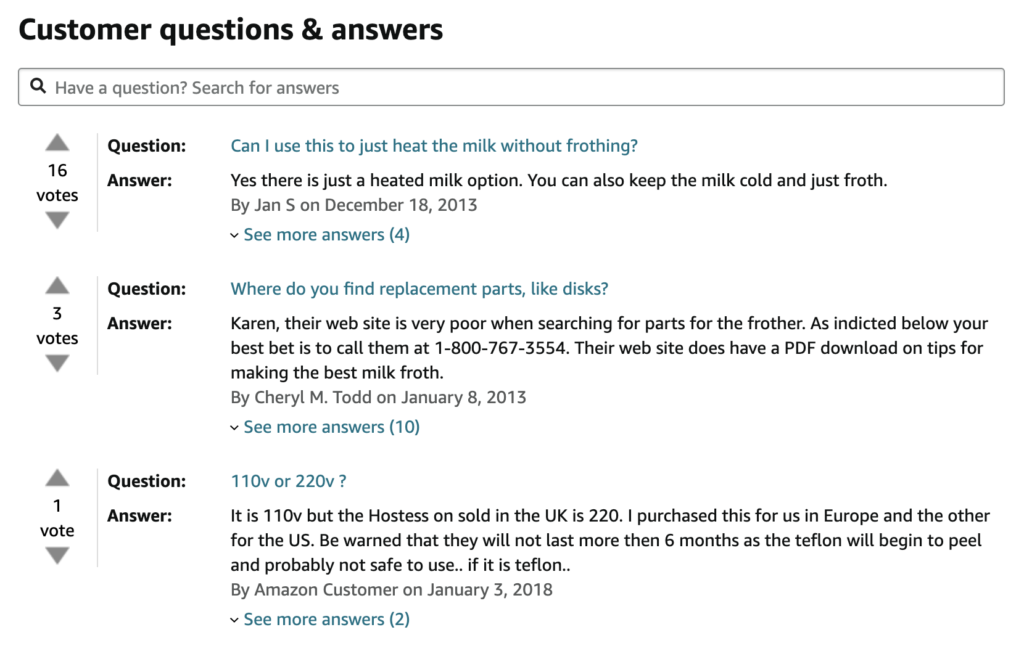

1. Display Q&A Alongside Reviews

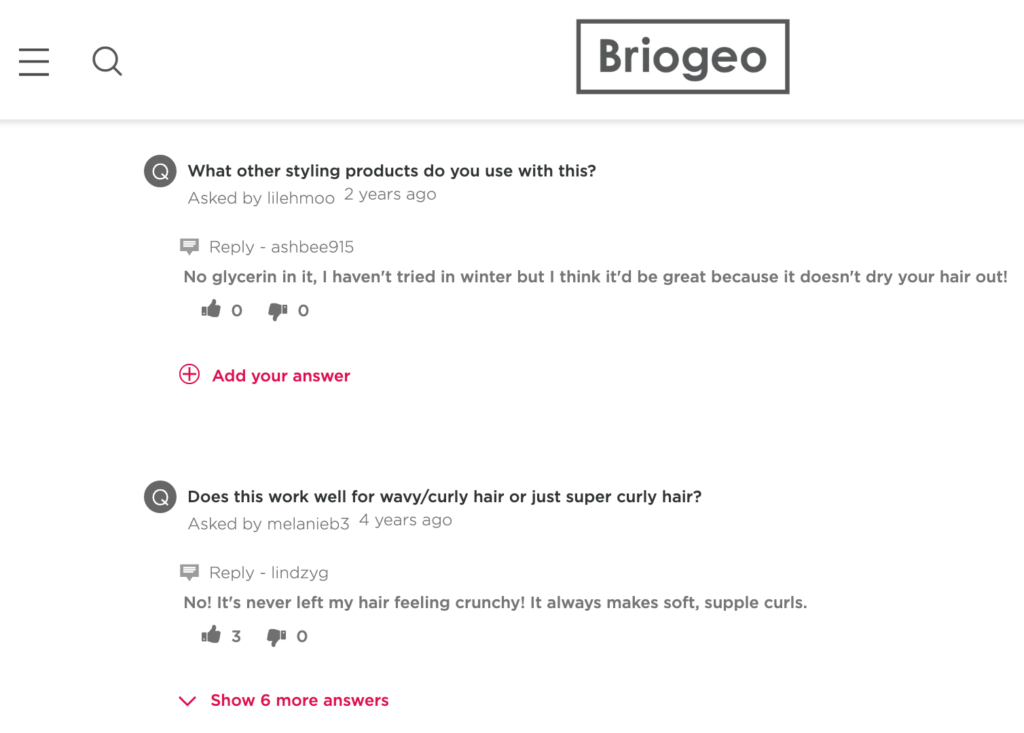

Nearly all (99%) of consumers read Q&A on product pages, and those who engage with it are more likely to convert than those who don’t. On the flip side, nearly a quarter of consumers are less likely to buy a product if there isn’t a Q&A section on the product page.

So be sure to add a Q&A section to your product pages that allows shoppers to browse questions that have already been asked, submit their own, and answer questions posed by fellow shoppers. A best practice is to display this content alongside your ratings and reviews so consumers can easily find all of the user-generated content they need to make informed purchase decisions.

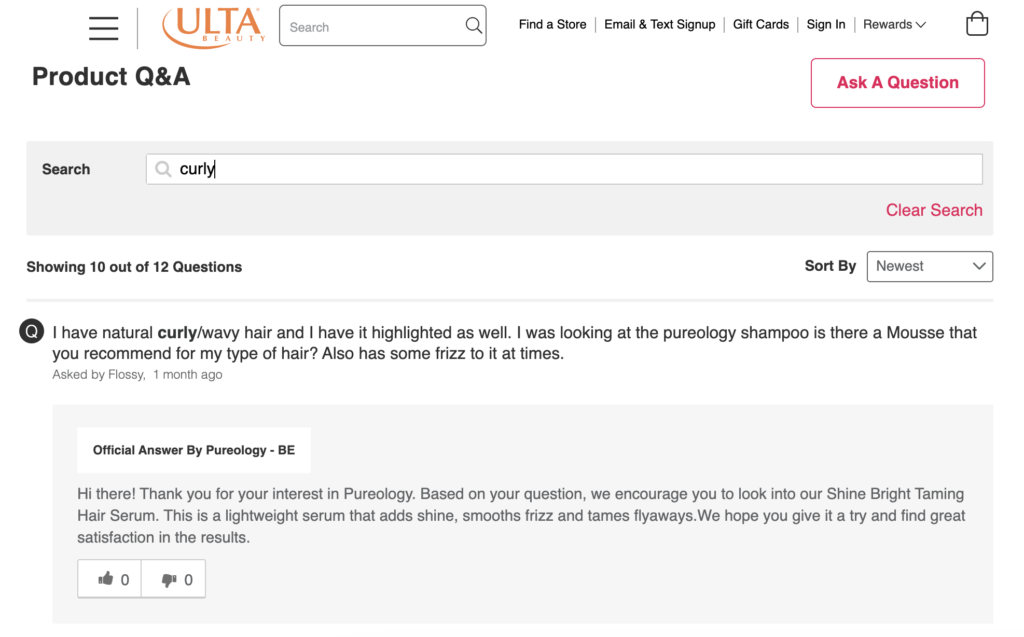

2. Make it Easy for Consumers to Search Existing Q&A

Shoppers read Q&A to get more information about various topics, including product quality, product experience and shipping. Make it easy for them to find the information they’re looking for by adding a search feature to your Q&A display. If a shopper finds a question similar to theirs, you’ll get less repeat questions. Plus, the shopper will get an instant answer — and they’ll be more likely to convert right away.

3. Provide Fast Answers to Questions

Over half of consumers expect answers to questions within a day. And nearly a quarter expect a response within four hours. Make sure you have a plan in place to ensure questions are answered quickly. If you respond too late, you risk losing the sale to a more responsive business.

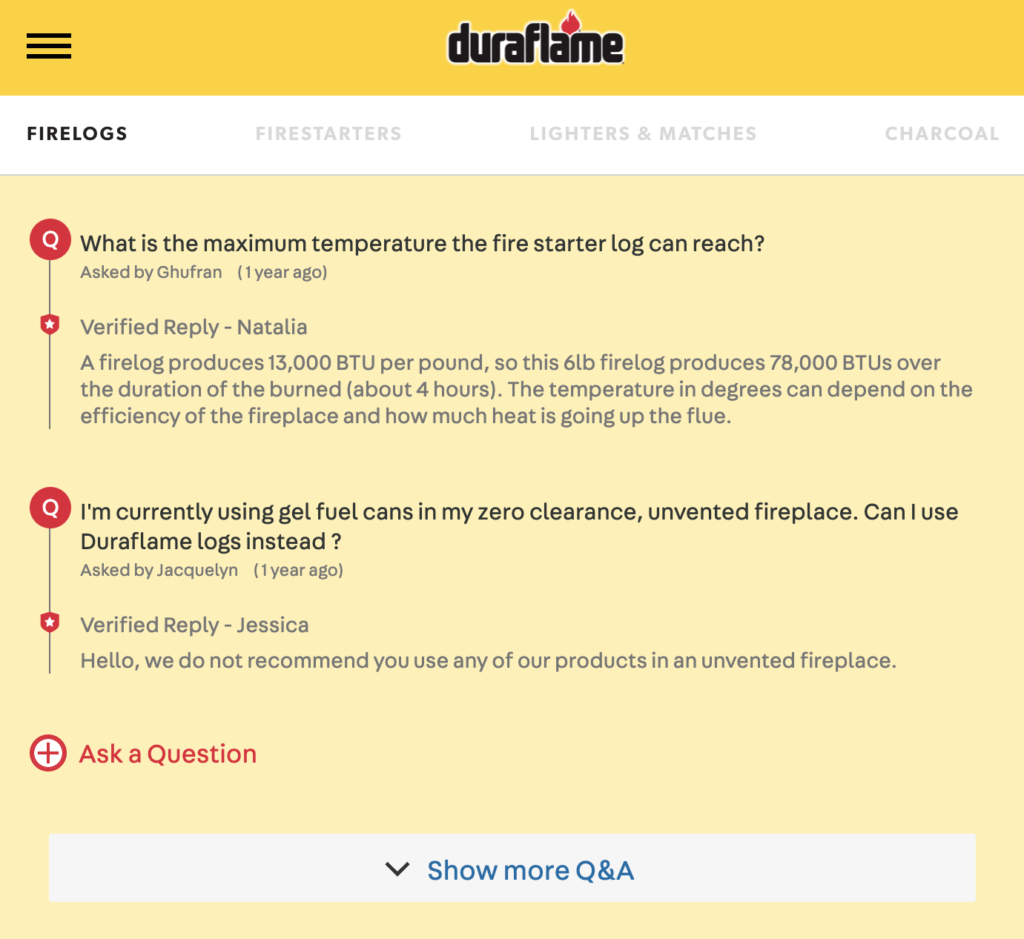

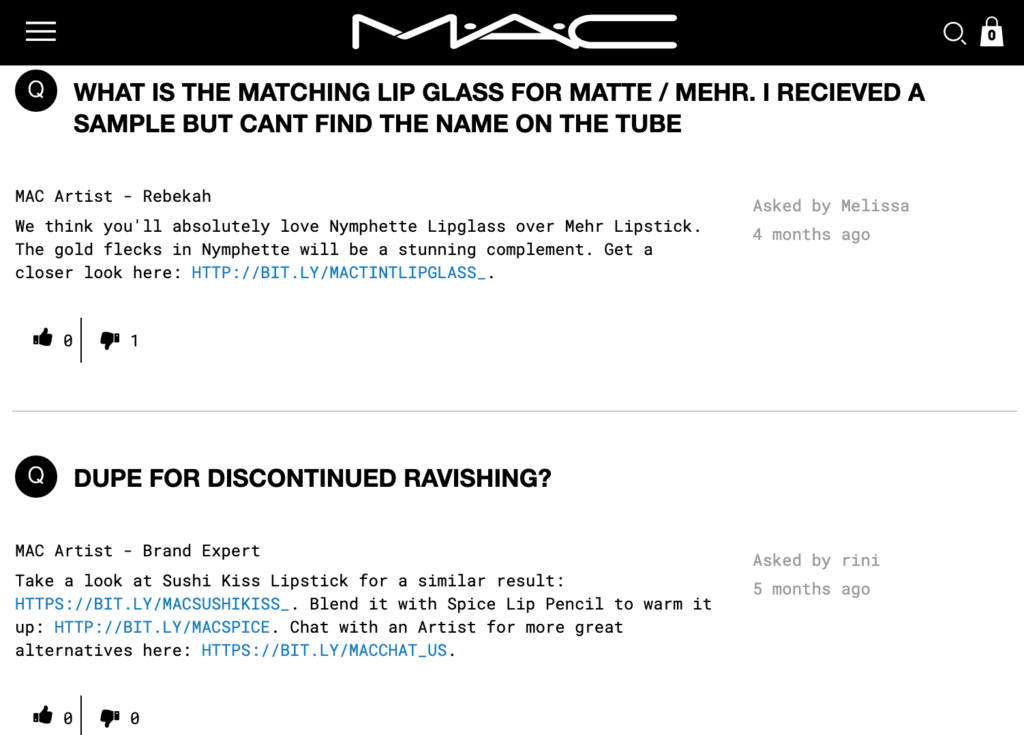

4. Allow Existing Customers to Answer Questions from Prospective Customers

Consumers value answers from other shoppers who have already purchased a product significantly more than answers from brands or retailers. So start allowing your current customers to answer the questions posed by prospective customers. Hearing about the experiences of fellow consumers will build your shoppers’ confidence — and the likelihood that they’ll make a purchase.

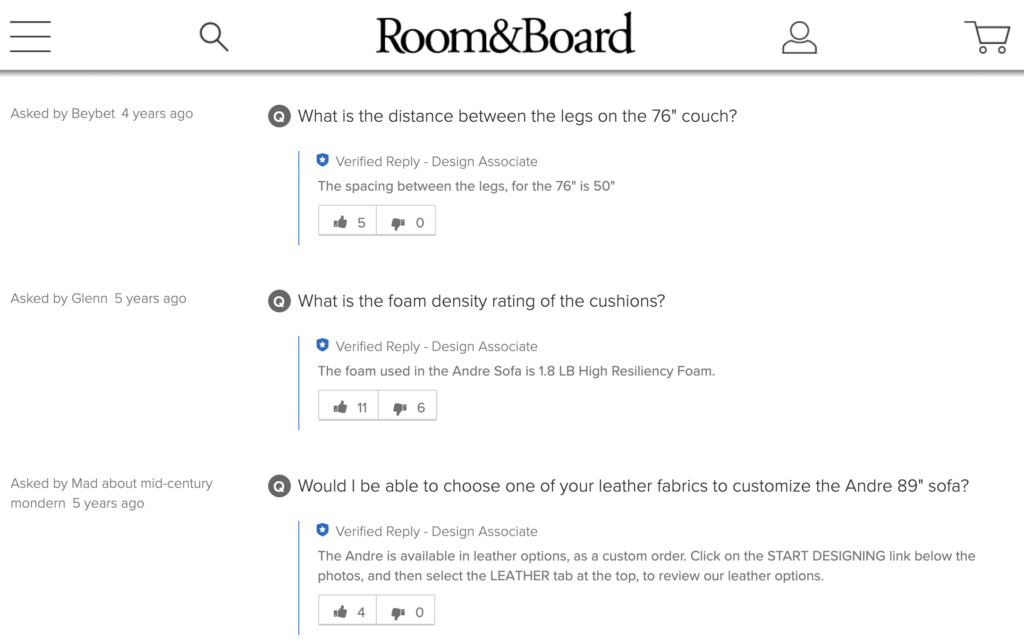

5. Disclose Who Answers Questions Submitted Via Q&A

82% of shoppers pay attention to the small print detailing who provides Q&A responses. So for the sake of transparency and credibility, be sure to include a badge or disclosure that makes it clear who submitted each response to a customer question.

6. Measure Q&A Performance and Optimize Accordingly

Developing a Q&A strategy isn’t a one time event. Instead, you’ve got to regularly measure the performance of your Q&A content. Then, use the insights you uncover to optimize your program and drive even bigger results for your business.

This article originally appeared on the PowerReviews blog; reprinted with permission.