Building a framework for reputation management:

Christopher Rivera @ Samsung

Christopher Rivera,

Samsung Electronics America

Benedict Nicholson,

NewsWhip

Topics

Samsung Electronics America’s Director of Reputation & Risk, Christopher Rivera, joins NewsWhip’s Head of Research and Editorial, Benedict Nicholson, to share about the importance of developing a reputational framework.

Guests

Chris Rivera has led as the Director of Reputation & Risk at Samsung Electronics America for more than three years. What you may not have known is that Chris’s initiation into the field of reputation and risk management curiously began about 17 years ago, as a technical writer. Follow Chris on LinkedIn.

Talking Points

- The reputation and risk landscape| Jump to text

- Defining risk | Jump to text

- Using social data in risk assessment | Jump to text

- Differences between risk & crisis | Jump to text

- Real-time risk management | Jump to text

- Reputation risk intelligence frameworks | Jump to text

- Benefits of a framework for managing risk & examples | Jump to text

- Planning for failure | Jump to text

- The relationship between risk and innovation | Jump to text

- Addressing unprecedented risks | Jump to text

- Reputation risk vs. enterprise risk | Jump to text

- Deploying crisis management teams | Jump to text

Benedict Nicholson: [Starts at 2:18] How does what you’ve done in the past and your past roles, how does that feed into what you’re doing now? Where did you come from to come to this position, I guess?

Chris Rivera: Well, Ben, the unfortunate part is when I went to college, I studied technical writing.

Ben: Oh, wow.

Chris: So I did not study risk whatsoever, and early on in my career, I started in project management working in IT, so I was very technical at that time. By the way, for anyone that doesn’t know what technical writing is, don’t worry. I don’t know if it even exists anymore, but basically I wrote a lot of user manuals on how to use technologies when people needed that. And one day at my job, my boss comes over to me and hands me over what’s called a business continuity plan. No clue what it is, and yet, that plan was basically the start of my career in risk because that’s when I was learning to basically prepare for emergencies and disruptions to our business.

Fast forward 17 years, I did business continuity planning, emergency management, which was great, working for the City of New York preparing for emergencies, more on a kind of life safety basis, which was really fascinating and fulfilling. I landed at Samsung about three and a half years ago doing reputational risk, and that pivot has been interesting because now I moved out of the kind of planning scenario testing phase into more of the real time, truly. When I say real time, I mean seconds and minutes, not real time in days and weeks, and just preparing for what comes our way.

Let’s move on a bit then to talk about the detectable risks today, and obviously we are going to be talking about risk a lot today, so it might be helpful for people who maybe don’t know exactly what that entails if we just define what we mean when we talk about risk. So if you could give us a little definition, a working definition, that would be great.

Chris: So if anyone’s behind a computer right now, we can all go to Wikipedia, right? And we can see, what does Wikipedia say? And it’s interesting because they say risk is simply something bad that could happen. The probability of something bad happening. But what’s not talked about is the other side of the coin of risk, which if you date back to the etymology of risk, you’ll find that there’s a Latin word named risicare that tends to be cited as the root word of risk, which simply put, nothing ventured, nothing gained. So risk really at its kind of core is to be daring. And what we’ve learned through some of the studies behind risk is it’s really a choice, not a fate.

So as we think about the technical risks, quite frankly, it’s really any action that we take as a company that could impact our brand. That is a risk. Now from there, the question is, how’s that risk perceived? And the reality and what we always train our internal teams on is to understand, and I’m sure this resonates for a lot of your audience, there’s no action we can take these days as companies that can go unnoticed by the media. The media are very quick, they’re very perceptive, and they obviously have to be because there’s a 24-hour news cycle and they need to maintain the latest and greatest sources of information. So for us, risk is really about, how do we protect our brand in this landscape of any action you take could have an impact on us?

Ben: That’s fascinating, it seems to be much more of a balanced scale than maybe people often first think about when they think about risk as maybe just a negative thing. So it’s I guess that opportunity stuff that we’re going to talk about later in the piece that I think is super interesting.

So obviously you work for a big electronics company, does that present different risks than an everyday B2C company or an everyday B2B company? There are these big cultural risks, obviously, but is there anything specific that you’re looking out for, or is it just, “We have to be aware of everything because we’re such a big company,” basically?

Chris: We have to be aware of everything, quite frankly. It comes down to product launches. It comes down to every customer service interaction. It comes down to any time that there is something broader in the tech landscape, we have to be mindful of what that is, because that could always have a broader impact on the industry. So our filters, as we set them up to listen to a lot of the noise out there, we have to stay attuned to all the noise to turn that into a signal from a reputational risk standpoint.

So we have social media as a big source of information. Any tweet that mentions us, we want to be aware of it. And that may seem overwhelming to brands that have a lot of kind of chatter where they’re being tagged, but it’s important because you never want to underestimate the impact of one tweet that could lead to one story on a very hyper-niche technical outlet that could then be picked up by, say a broader outlet. And worst-case scenario, you obviously don’t want to be on the negative end of a Wall Street Journal story.

Ben: … You talk about [things moving] between platforms, [which] I think is a super interesting part of this. Is it isolated in one community or one space or one network? Or has it moved from Twitter to Facebook, or from Twitter to someone’s blog, or whatever it might be? And I presume you’re looking at kind of engagement levels and volume of tweets and that stuff.

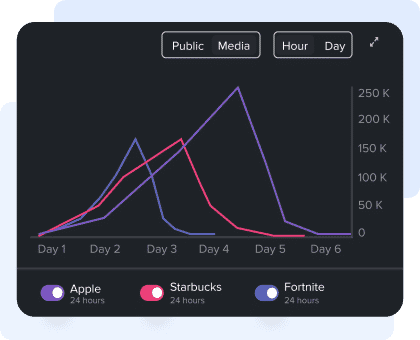

Chris: Yeah. So let’s take the NewsWhip dashboard, because I think we were with NewsWhip before you guys rolled out that dashboard, and then we’ve been with you since you’ve rolled it out. So before the dashboard, it was a little hard for us to kind of understand where that convergence happens between, what is the media interested in over time, and what’s the public interested over time? But now with that lens in mind when we run that dashboard, we’re able to see exactly what you said. It starts with public interest and then carries over to media interest. That’s interesting and very telling.

And then the opposite is also interesting, which is, what if there’s a high volume of media interest, but a low volume of public interest? So I think what you start to do is, and we’ve trained our teams in visual decision-making. So it’s using that dashboard almost as a way to determine, “Okay, if these graphs start converging, that may be a different type of response that we have to prepare for,” versus a traditional, say you’ve received a media inquiry, now you’re off to the races to respond to it.

Chris: Yeah. Well, for myself, crisis management really comes down to preparing for an unknown event at an unknown time with an unknown impact. So I’ll give you one quick story. The Miracle on the Hudson, United airlines. That in a lot of ways is crisis management because you have a trained pilot, you have a trained co-pilot, and they did nothing wrong. They took off as planned. Unfortunately for them, as they took off, a flock of Canadian geese came flying into their windshield and took out one of their engines. Now what’s fascinating about that as well is it shows, in the case of Captain Sully, who took the reins and figured out he’s going to land a plane on the Hudson River, which has never been done, in that sense, crisis management was really about decision-making in a crisis.

You have high stakes and you need a framework in which to say, “I need to get this down.” Now, none of the air control towers that he radioed had that plan for him, he completely improvised that. And I think a lot of brands sometimes find themselves in that situation, having to improvise and saying, “Wow, we’ve written this prescribed plan of, ‘Here are all the things we need to do,'” and then you throw the plan out because it’s useless. Risk management is a little different in that it’s kind of held together with more statistical analysis, more history. You have a little more context and you have a little more psychology that plays into that.

So the interesting thing about risk for us is, as I said before, you can kind of turn that insight from looking at risks. And that’s another great way, by the way, to use NewsWhip is why don’t you run simulations off of issues that you’re seeing right now, and what type of coverage that is, and how people responded? So you can benchmark your potential risk response with NewsWhip, as well as just during it, if you needed to for your own brand.

Chris: So a couple things. I think dashboards is [where I] spend most of my time, in setting those up to kind of give me the real-time insights. And as I said before, with us, real time… The great feature of NewsWhip is you can set to the most recent, not the predicted impact or the other categories, but if you set to most recent even before engagement has started, what you’re seeing is a steady flow of, “Hey, this is coming in.” So I think to answer your question, how do we use that? Well, I generally start with a funnel. That’s kind of how my dashboards are set up. So if we take a step back, and I have to check this, but I think, Ben, last I heard, Pew Research put out a paper that said there’s about five million stories a day, somewhere in that range.

Ben: Yeah.

Chris: So now how do I take that five million and get it down to, “Here are the 10 things I care about and I want to see.” So we set up our dashboards with overly complex Booleans, as I’m sure all of you have, and that helps us kind of find the needle in a stack of needles, because we also care about the five million. It’s needless to say we’re kind of on the line for knowing a lot of things in a very short amount of time.

Ben: Yeah. And anything we can do to help that, that’s great.

Chris: Yes.

Ben: So I want to move on a bit and talk about the strategy and tools to detect risk, so you’ve talked about this reputation risk intelligence framework with us before, what does that entail, and how do you go about building something like that? Is it just an iterative process, or is it you’re kind of predicting things? How are you approaching that?

Chris: Yeah. So it started with a process. So what we did was we defined the top things we care about reputationally, and then we started looking at technology solutions to enable and make that process faster. Rudimentary folks can start with a very simple Google search, but you can imagine that’s not sustainable. But what we did is through that process, we figured out who are the influencers? Who are the folks that speak about us? Who are the folks that probably cover us somewhat, versus those that are solely focused on our beat? And we sort of started pre-codifying a lot of those things.

There’s still always outliers. I think in the world of risk, we could probably know 80% or more of the things that are most likely to impact us, but then there’s that 20% where you’re like, “Wow, we never caught that. Now we need to start looking at that.” Whether it’s a new social media platform, and I know this is a space you guys have talked about before with misinformation. You have to kind of keep up to speed with a lot of things that are just changing. So yeah, our framework was really designed around looking for signals, and then analyzing those signals, and then training our people to detect patterns. And then we figure out, how do we push that information internally to the right people to get the subject matter experts around the table to figure out the appropriate response? It’s a framework, Ben. It’s not a plan.

Ben: Gotcha. And that’s an important distinction to draw, I think. So talking broadly then, what risks are worth accepting, not just for Samsung, but for any company that’s thinking about this? Is there a threshold of risk that every company should be prepared to absorb almost, I guess?

Chris: I think just like you would sit down to eat a meal, every company should sit down to think about their appetite, and if your appetite for risk, depending on the nature of the brand you have, if you’re a leader in a space, quite frankly, it’s very hard to take certain risks that you can take if you’re kind of an up-and-comer or you’re a disruptor. I think as a leader, there’s more eyes on you. And so the stakes are higher, so you want to lower that margin of error because what you don’t want to do is chip away at the reputation you’ve built, which we all know takes time.

Reputations, I think … goodness, [the name of the attributor to the quote] is at the top of my mind, but I can’t remember it. They take years to build, but seconds to destroy, and I think that’s kind of the challenge is you kind of have to right-size your risk based on your business. If you’re in technology, you’re probably going to have to take a lot of risks, but I don’t know, our model is always, let’s take intelligent risks, not just throwing caution to the wind.

Chris: Well, the framework allows you to adapt, so what you generally do is … one common framework, it’s called a command and control model. And what it does is it allows you to understand the problem that you’re dealing with, so you constantly are almost your internal investigator for your company. You know, “What are we doing? Why are we doing it? Who’s in charge? What’s the backup plan if that doesn’t go right?”

And then you do scenario planning and you go from there, so it really just starts with a very clear understanding. And oftentimes, this is sometimes where certain risk programs in my past life failed, is there wasn’t a clear understanding of what the problem is, so brands go off and they start developing solutions to issues that they think are solving an issue, but they’re really not. They’re making it worse.

There’s a great case study in a book called Reputation Rules around an issue that Mercedes-Benz dealt with around their A-Class model, where, just to kind of really tighten it up, they initially thought, “Well, the public doesn’t necessarily understand the risk related to these swerving maneuvers,” because they tested this A-Class model, a journalist, the vehicle flipped over, but then they found out no car company could have ever passed that test based on the maneuvers. However, it’s the company’s response that dictated the reputational impact. And I can talk more about it, but I won’t in the interest of time.

Ben: But then, so you talked about failure, and I think that’s really interesting, do you then have a framework for failure as well for when you’re-

Chris: We plan for failure. Yes. We plan for failure.

Ben: Okay.

Chris: That’s often the biggest problem is most folks want to plan for success. In our space, in risk, we’re constantly planning for failure. And there’s a really well-known psychologist named Gary Klein, Dr. Gary Klein coined the term premortem. What does that mean? Well, the irony is everyone says, “Let’s do a postmortem, let’s do a postmortem, let’s do a postmortem.” That benefits everyone except the dead person. So what Gary Klein coined was, “Well, what if we could think about all the potential ways something can go wrong and develop mitigation strategies before we do that? How does that apply to the real world?”

If you’re going to launch a new product, you probably want to do a premortem, and why not use a tool like NewsWhip to say, “Okay, we’ve come out with these risks, now let’s see, how do folks feel about this?” Whether it’s on the social vector scale of NewsWhip or the online news sources, and then you can start to go from there. I think another thing too, for those of you that are using the research function, which I know is your wheelhouse, Ben.

Chris: And then you have even more historical context. So you’re not just going back a few months, you can go back years to really see volume and compare.

I want to talk quickly before we wrap up about opportunity and risk, and learning and future innovation and stuff, and if people have questions, now would be a great time to start putting those in so that we can get to those in a few minutes. But risk looks ahead, Chris, as does innovation, so how would you describe the relationship between those two things, risk and innovation?

Chris: So risk and innovation, I think where they do complement each other, think about it. We would have never built a plane if we were risk-averse. Engineers at some point had to build a bridge. If we were so risk-averse, we would never do these things. So the idea and how we can apply it is if we change our mindset, that’s I think the biggest step is understanding kind of, “What’s our comfort level with this?” And then you sort of work through different scenario plans to figure out, “Okay, we can innovate here safely. That area may be a little difficult.”

Oftentimes too, there’s just probably not enough research done in some cases, and so folks are quick to innovate and put something out to market before there’s proper case studies around how to customers. I think if you’re in the innovation space, sometimes you probably learn more about how your product’s being used from social media than you probably ever intended. Engineers can only think of so many things. So I think you kind of balance that out, but you have to take risks to innovate.

Ben: Yeah. And I think that’s the key there is nothing would ever change if people weren’t at least a little willing to take risks, right?

Chris: Yeah. We’d never have insurance. There’s just so many things that would have never been created if risk weren’t a part of that process.

Chris: There is a lot of work that goes into something of the scale of a pandemic, and honestly, that’s, for us at least, one of the key steps in this whole process is just understanding the landscape. So what you’re constantly doing is you’re scanning and scanning and scanning. It’s almost as if you’re setting up your own sonar system in your company, and what you have to do then is take all that data. In the case of the pandemic, as you said, early on, understanding what’s being closed? How are things being closed? How soon are they being closed? Who’s kind of the prominent voice that you have to follow guidance? Is the guidance matching?

So I guess you just kind of … no different than 10 planes in the air that a sonar system would pick up, then from there, you’re kind of in an air traffic control mode to say, “Okay, we have to move the business forward, but here’s the information that the business needs to know about.” So our goal, I think, and anyone’s goal in this space is to have more intelligent responses, and I think that’s what’s key is the intelligence comes from information that you’re able to digest correctly.

Ben: Yeah. Even contextual information can help that, even if it’s not specific to that crisis or to that risk. You can draw context from similar events in the past and et cetera. Okay.

Chris: Yep.

Ben: That’s great. We do have a couple of audience questions.

Chris: Yeah, absolutely.

Chris: Wow, great question. I haven’t found the silver bullet, but what I’ve found is if you look at enterprise risk management, reputational risk is almost that vertical. So you can have legal risk, you can have financial risk, you can have sales risk, and then there’s that kind of brand reputation vertical within your enterprise risk management program, where if you take a certain action through enterprise risk, you might rate the likelihood and the impact of said reputational risk as high, whereas the business may say it’s low because we want to enter into this new market. So for me, I guess, Belinda, it really goes back to your scorecard of how do you define those, and be happy to connect more separately on LinkedIn if you have specific questions.

Ben: And presumably, reputational risk kind of sits across all those. You described it as a vertical, but reputational risk can become a financial risk presumably as well.

Chris: It can, but at least the way I view it is we separate it out.

Ben: Okay.

Chris: Because then it allows us to get differing perspectives, because oftentimes you want to find somewhat of the average or mean of a particular risk across those verticals and then dive deeper. It, at least for me, has helped.

Ben: Okay, great… another question has come through. The approach to assembling a crisis management team once that crisis hits. Are you involved with that or does that get outsourced to other departments, or are you guiding that, or is there a PR agency involved? What exactly is the approach there?

Chris: Yeah. For us, given the sensitivity of any crisis, we keep it all in house. And what we typically do is we have a, I sometimes call them ad hoc working groups, and I don’t think everyone loves that term, but here’s the reason why. Oftentimes, it depends on the nature of the crisis you’re dealing with that determines who should have a seat at the table. So while it’s very important to have the same people around the table all the time, there’s different issues that require different subject matter expertise.

So yes, I’m involved in it, and what we often do is make sure that we have the right subject matter experts at least to take charge of a particular situation, and then we hand it off to the other stakeholders to help kind of manage and address subsequent tasks below the kind of primary person that’s in charge. They call them incident managers in some places.

Ben: Okay. Yeah, I think that’s all the questions we have there, Chris.

Chris: Okay.

Ben: Thank you so much for doing that. Is there anything you think we didn’t talk about that you’d like to say quickly, or if people should reach out to you somewhere, is there a place where they can do that?

Chris: Yes. Please reach out on LinkedIn if we’re not connected already. Thank you for all those that joined. And I guess the last thing I would say, Ben, is there are a lot of books in this space that I would love to recommend to folks, so if you want to shoot me a note, I’d be happy to kind of share with you some of the resources I’ve found valuable in my own journey with this discipline.

Ben: That’s brilliant, Chris. I’m sure people will really appreciate that.

Chris: Sure.

Ben: Just before we go, I want to plug quickly the next webinar that we’re going to be doing, which is in two weeks’ time, that’s going to be with Zach Silber, who is the chief information officer at Kivvit. And we’re going to be talking, Brett Lofgren, who’s our CRO here at NewsWhip, and president, is going to be talking to him about building the bridge between infrastructure and data-driven media intelligence. So that should be a fun one for everyone to attend.

Thank you so much for all of you who have listened along here, and Chris, thank you so much for attending. I know I found this conversation fascinating. I think our audience has as well from some of their reactions, so thank you again so much for joining us.

View our on-demand webinars

Lessons for brands from the frontlines of social media manipulation

Governments globally, particularly in conflict zones, confront the persistent threat of social media manipulation, as evidenced by ongoing information warfare in regions like Ukraine. However, there are dedicated organizations such as Valent Projects actively working...

When distrust defines society’s relationship with government & media

Humanity’s potential for progress and creativity risks sustained damage when distrust is the foundation and society is no longer characterized by positive relationships with government, media, business, and non-governmental organizations (NGOs). Still, data from this...

Mastering the balance of mixternal communications

In the midst of talent wars, mixternal communications is a juicy topic at companies intent on attracting and retaining employees. We examine addressable opportunities to bring balance to internal and external communications. For the first NewsWhip Pulse episode of...