Customer lifetime value is an important metric that measures how much value a business can reasonably expect to make from a single customer during the course of their relationship.

CLV is a relatively straightforward equation and it can become a metric small business owners can get to grips with and use right away—despite the changing nature of products, costs, and purchasing frequencies.

In this post, we’ll look at CLV in its simplest terms and show you why the metric is so important for your business. Armed with the right knowledge and the right tools you’ll soon be able to measure customer lifetime value (CLV) quickly and easily.

What is customer lifetime value?

Customer lifetime value measures the total income a company predicts it will generate from a customer over the course of their entire purchasing history.

CLV is calculated by looking at the total average revenue a customer brings in and the total profit. The above two figures offer important insights into how customers are interacting with your business. They’ll also give you an idea about how well your marketing strategies are working (or not).

The metric can be used to identify your most profitable customer segments and it’s something your customer reps and support teams are able to directly influence during their interactions with customers and clients during their customer journey.

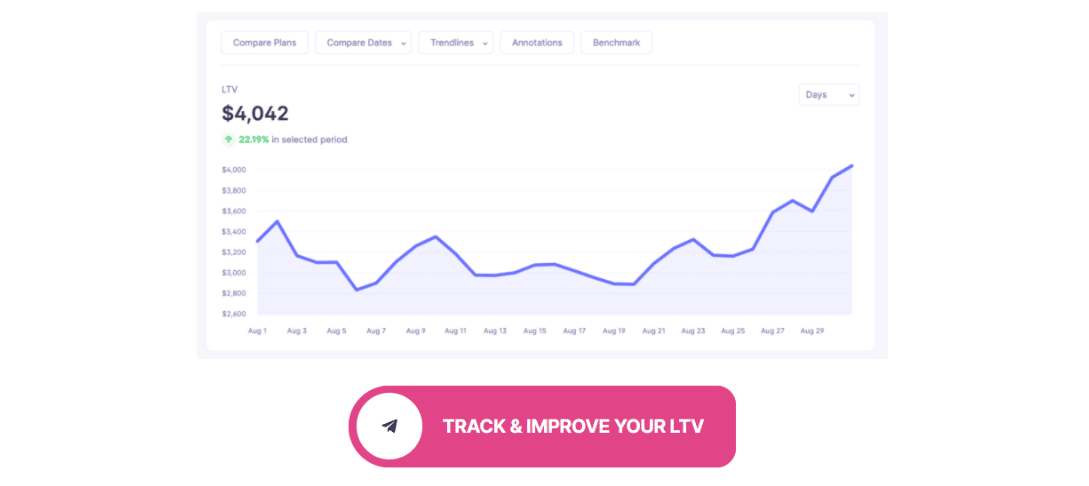

To gain a more granular understanding of CLV you can break it down by month, year, quarterly – or by selecting a specific customer segment. This can give you better insights into what’s working with your highest value customers or clients—then you can apply the same strategy across your entire customer base.

There are several ways to look at CLV rather than one. These comprise of:

- Basic calculations which look purely at revenue

- More complex calculations take into account gross margins, and operational expenses; COGs, shipping costs, and fulfillment. Sometimes marketing expenses such as the cost of running your affiliate marketing program, may be included – but, if these tend to be highly variable they’ll probably be left out of the equation.

Customer lifetime value models

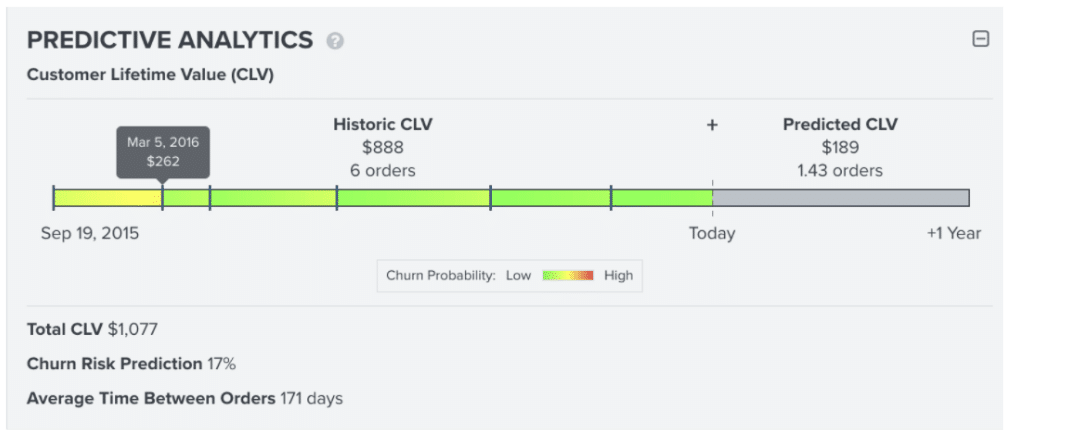

Companies can use two models to measure customer lifetime value: historical and predictive

Historical customer lifetime value

This is based on historical data to predict a customer’s value and doesn’t consider whether a customer will stay loyal to a company. In this model, the average order value determines the value of a customer. This can be a useful way to measure AOV if your customers tend to interact with your business for a specific period of time.

There are disadvantages to this model: active customers (those deemed valuable over a set period of time) may become inactive which could skew your calculations. There’s also the possibility of overlooking repeat customers who’ve previously been termed inactive.

Predictive customer lifetime value

The predictive CLV model makes assumptions about the buying behavior of existing and new customers. This helps to identify valuable customers as well as the products or services bringing in the most revenue and gives you clues about how to improve customer retention.

Why is customer lifetime value important?

Why should a business care about CLV? Here are a few reasons why.

-

CLV directly affects revenue

CLV identifies the specific customers bringing the most revenue to your business. Having this information means you can serve these customers with products or services they prefer, boosting their satisfaction rates, and increasing the chances of them buying more from you in the future.

-

CLV indicates high rates of customer loyalty

Companies that optimize CLV and provide customers with consistent value in terms of customer support and high-quality products tend to have high customer retention rates.

-

Helps you to target your best customers

Once you understand the lifetime of your customers you will be able to see how much they’ve spent with you over a time period, be it $30 or $3000. You’ll then be able to create an acquisition strategy that targets them.

-

CLV can help you reduce customer churn

Acquiring new customers is expensive compared with retaining them. This indicates that it’s essential to identify and nurture your best customers so that you’ll have higher profit margins and reduced customer acquisition costs.

-

Improves forecasting

CLV enables you to make informed forecasting decisions with regard to inventory levels, production capacity, staffing, and more. Your sales and revenue operations teams can help to boost efficiencies behind the scenes and ensure staff have the right tools and training to help you create the most accurate forecasts.

-

Increases profitability

A high CLV should lead to higher profitability. Keeping customers for the long term and having a business model that motivates them to spend more should reveal itself in terms of a boosted bottom line.

Once you understand your CLV you’re able to make better business decisions – especially when it comes to sales and marketing. Once you’ve gained an understanding of the various parts of your CLV you can start to test out different strategies to discover what works best for your company and custom (UI) is providing customers with the best CX.

How to calculate customer lifetime value (CLV)

Calculate CLV by calculating the ‘average purchase value’ multiplied by the “average number of purchases” to determine customer value.

Once you’ve calculated the “average customer lifetime” multiply that by “customer value” to arrive at your CLV.

- Customer lifetime value = customer value x average customer lifespan

- Where customer value = average purchase value x average number of purchases

The terms involved in the equation:

You may be wondering how to work out the components involved in the CLV calculation so we’ll outline these below:

- Average purchase value: this can be calculated by dividing total revenue over a set period (generally one year) by the number of purchases in that period.

- Average purchase frequency rate: divide the number of purchases by the number of unique customers who made purchases during that period of time.

- Customer value: multiply average purchase value by average purchase frequency rate.

- Average customer lifespan: take the average of the number of years a customer continues purchasing from your company.

- Customer lifetime value: multiply customer value by average customer lifetime to arrive at the amount of revenue you can reasonably expect an average customer to bring during their relationship with your company.

How to improve customer lifetime value

Once you’ve worked out your customer lifetime value you can take steps to improve it including the following.

-

Exceeding your customers’ expectations

Many brands overpromise and underdeliver so make sure you’re not doing so. Make a point of delighting your customers at every turn so you come across as a company that delivers on your promises.

-

Increasing average order values

One straightforward way of boosting your CLV is to increase your average order value. When customers are checking out, offer them products that complement those they are about to buy. Amazon is a good example of a company that upsells and cross-sells very successfully. They offer related products and bundle them together to show you a group price.

Starbucks is another example of a company increasing order values whereby staff ask customers at the checkout if they’d like to upgrade to a larger coffee or have a cookie with their drink.

You can use insights from behavioral email marketing to establish customer preferences and upsell to them. Subscription-based companies can increase AOVs by encouraging customers to move to a higher value annual billing cycle.

-

Nurture relationships with existing customers

To increase CLV and reduce churn you need to engage with and build a relationship with your customers on all types of communications channels.

The following practices may help:

- Listen and interact with customers on social media

- Seek and act on customer feedback

- Send loyal customers rewards to boost retention and drive repeat purchases

- Provide customers with a FAQ – if you provide telephony services customers may wish to find out ‘What is a VoIP number?’ Providing answers to questions like these can help educate customers and establish trust and loyalty in your brand

Optimize your customer service

Your customer service plays a big factor in whether customers will choose to shop with you again and how much they’ll spend with you. In order to increase your CLVs look for ways to ensure your customers’ experience is outstanding.

Consider offering existing customers more personalized offerings and discounts, make sure you’re providing service on all relevant channels, and have clear return and refund policies.

A quick way to deliver customers a better experience when they get in touch is to provide them with a toll free telephone number.

Conclusion

Customer lifetime value (CLV) is a useful metric that provides you with a way to see which customers spend the most with you and which will stay loyal to you over the longest period of time. If this is a metric you’re not currently tracking, we hope this post has helped to change your mind.