With the FIFA Men’s World Cup finals winding up last weekend, MediaPost recently reported that “through the quarterfinals round of the 2022 FIFA World Cup in Qatar, an estimated $213.6 million in national TV advertising was placed on the Fox TV networks and NBCUniversal’s Telemundo channels” that resulted in a collective 8.4 billion impressions.

As we’ve seen and evidenced, leveraging advertising and marketing to drive talkability is important because conversations among consumers drive about 19 percent of purchases, including conversations that are triggered by paid advertising—we find that one-quarter of the impact of advertising on sales occurs by causing consumers to talk about the brand.

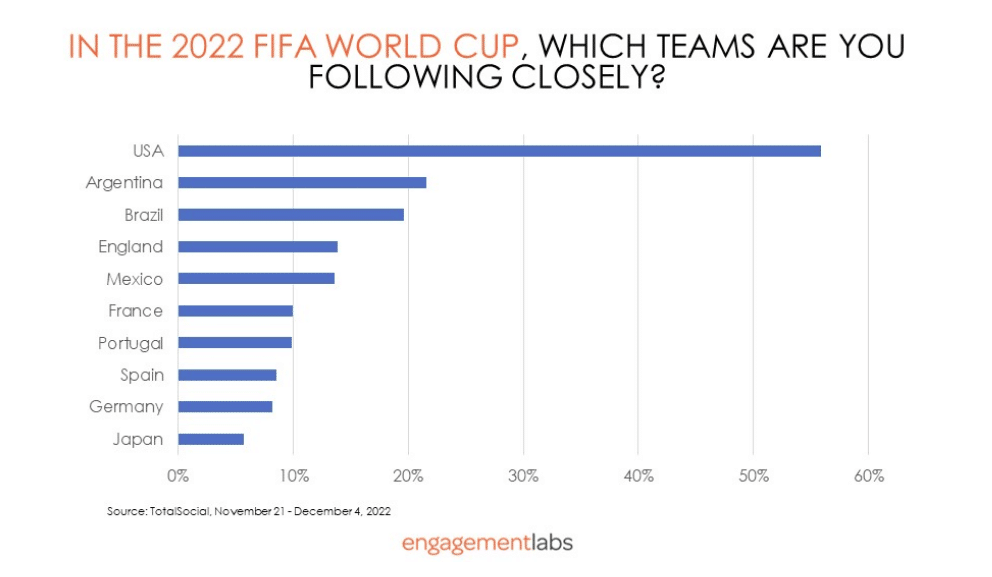

Engagement Labs data are shedding light on the importance of a special group of consumers: World Cup viewers. Around one-third of American consumers ages 13 to 69 reported watching any of the FIFA World Cup games through Sunday, December 4th. While over half of viewers report following the USA closely, around one-in-five Americans are closely following Argentina and Brazil, while just shy of 15% are behind England and Mexico.

As seen in our analysis prior to the World Cup, soccer fans are a lucrative group of consumers for brand marketers. So, it isn’t surprising that World Cup viewers:

- Engage in 95 category conversations each week (33% more than non-viewers), with the biggest gaps seen in travel, sports, children’s products, technology, household products and personal care and beauty

- Are 2.7x more likely to be everyday consumer influencers versus non-viewers

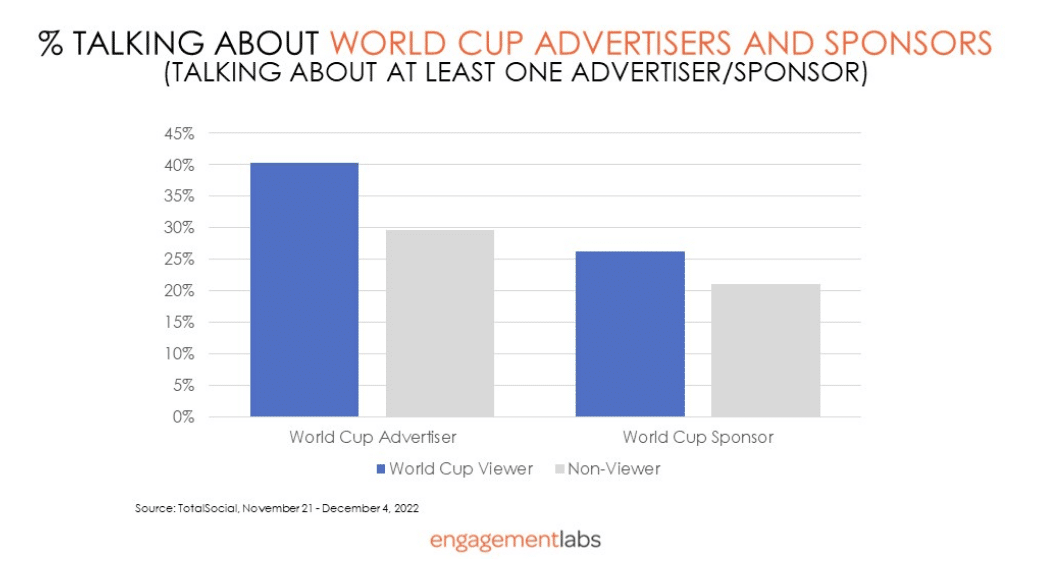

During the past couple weeks, these more prolific viewers have been exposed to World Cup advertisers and sponsors. In turn, we are seeing 40% of World Cup viewers engaging in conversation about at least one advertiser—a big +36% lift from non-viewers. World Cup sponsors also get a boost with 26% of viewers talking about a sponsor which is 25% higher than non-viewers.

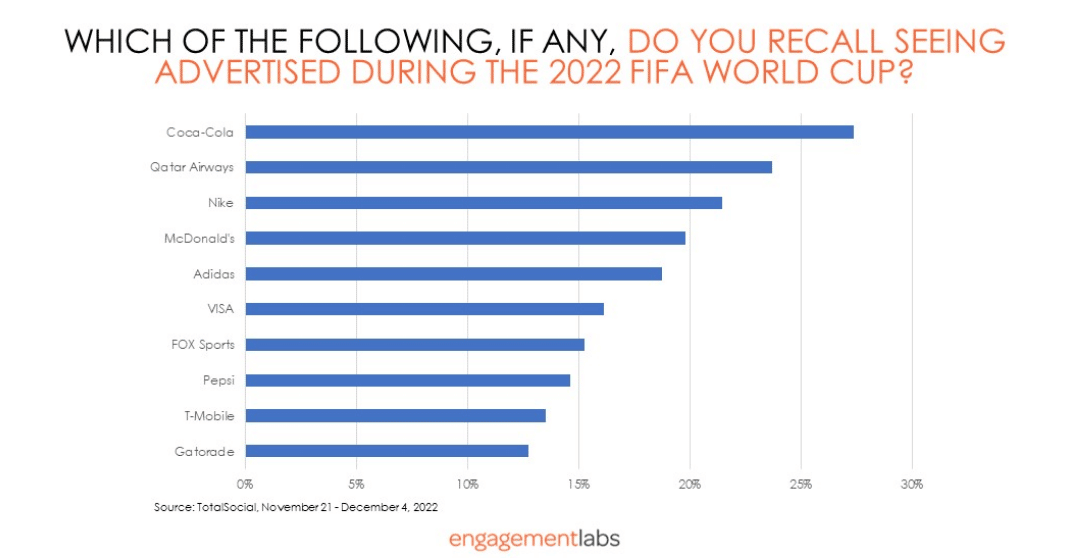

Which advertisers and sponsors are the biggest winners in terms of conversation? There are a number of ways Engagement Labs can explore this. For one, we ask World Cup viewers to tell us which brands they recall seeing advertised during the World Cup. During the past couple weeks, Coke, Qatar Airways, Nike, McDonald’s, and Adidas top the list.

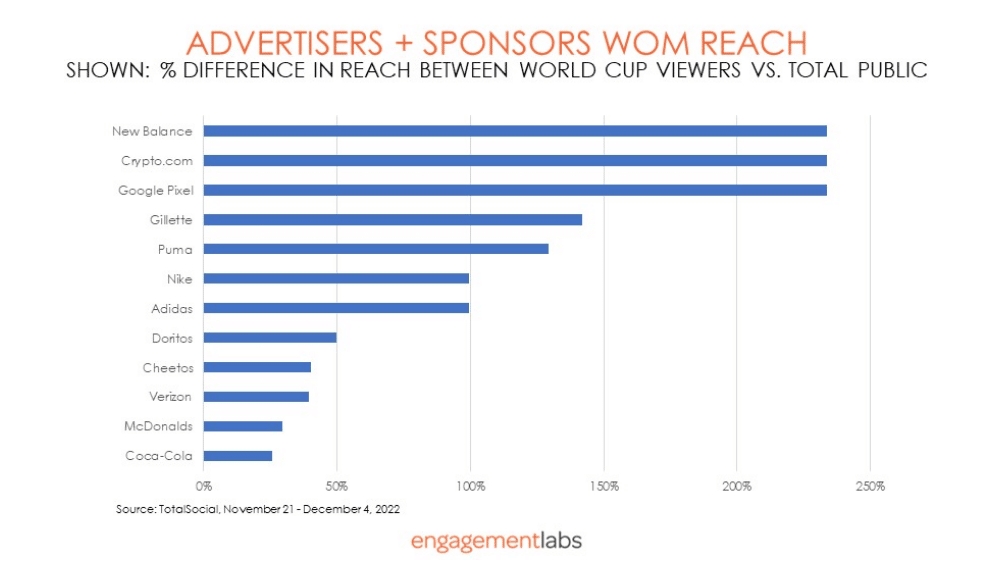

Another way to explore which brands are benefitting from the World Cup is to uncover which brands have the most conversation lift among viewers. During the first two weeks of the World Cup, New Balance, Crypto.com, Google Pixel, Gillette, Puma, Nike, Adidas and Doritos are seeing 50% or higher percentage difference between those watching as compared to the general public. Verizon, McDonald’s and Coke also have a strong increase, especially considering just how big these brands are in terms of conversation.

As the World Cup progresses during the next couple weeks, it will be interesting to see the shift in teams being followed and supported, as well as sponsors/advertisers discussed.

Insights for brands and media: Sports sponsorships, Super Bowl, NBA

Each year, Engagement Labs studies the social media buzz and word of mouth lift associated with the Super Bowl. As we declared in Marketing Dive, that USA Today’s Ad Meter — the most widely used indicator of advertising success in the big game—”doesn’t work, and it is destined to fail again next month.” We based this on an extensive analysis of Super Bowl ad study published in the peer reviewed Journal of Advertising Research.

In 2023, we foresee Super Bowl ads that drive the most offline and online social engagement – engagement that leads to proven business outcomes—are not the ones highly rated on the popularity charts. And similarly, the most popular ads measured by USA Today are often not achieving the highly important goal of creating the buzz that drives consumer behavior.

For media and entertainment executives looking for insights and data sets to demonstrate the value of their audience and ads, Engagement Labs is able to analyze and provide data valuable for ad sales stories and influencer marketing across a range of advertiser categories.

In 2018, AdAge featured Turner Sports collaboration with Engagement Labs to measure the value of out-of-home audiences for advertisers during NBA on TNT’s coverage. Out-of-home viewership produces an extra “social” value to advertisers.

Some of our findings include:

- Out-of-home NBA viewers delivered a 100% lift in purchase consideration of 9 sponsor brands over non-NBA viewers, compared to an 85% lift for in-home NBA viewers.

- There was an increase of +125% in word-of-mouth volume about those same nine advertisers by out-of-home NBA viewers, compared to a 75% volume lift by in-home viewers over non-viewers.

- In addition, NBA out-of-home viewers exhibited a 51% lift in ad recall over non-viewers, similar to the 49% lift achieved by in-home viewers.

- According to Nielsen’s National Out-of-Home Reporting Service, during the 2018 NBA on TNT Western Conference Finals, out-of-home audiences delivered a +10.9% lift in adult 18-49 viewership (above and beyond in-home viewership), while adults 25-54 achieved a 10.1% lift. By measuring out-of-home viewing, advertisers are provided valuable incremental audiences beyond standard in-home viewing.

This article originally appeared on the Engagement Labs blog; reprinted with permission.