On Sunday morning, I was lurking in Facebook and came across a news article in Jeff Esposito’s timeline.

Titled, “The new Facebook patent could make you rethink your friends list,” I was intrigued.

I read the article and was shocked at what I found.

The gist of it is that Facebook bought (for a mere $41 million) several patents, which came when it bought Friendster back in the day. And, one of those patents was approved last week for Facebook to use.

The new Facebook patent, while billed to “help filter spam emails and offensive content and improve searches,” could also “allow lenders to use your social habits to determine a credit approval.”

I did some digging—mostly because we’ve all become cynical to everything we read online—and it looks like it’s true.

Could Your Friends Determine Your Loan Application?

From the patent, which SmartUp Legal found (thank heaven because I’m not about to read a patent filing):

When an individual applies for a loan, the lender examines the credit ratings of members of the individual’s social network who are connected to the individual through authorized nodes. If the average credit rating of these members is at least a minimum credit score, the lender continues to process the loan application. Otherwise, the loan application is rejected.

What this means is, when you apply for a loan, the Facebook patent allows lenders to look at the credit scores of your Facebook friends. If you have a bunch of friends with below-the-minimum credit scores, your application could be rejected.

I don’t know about you, but I don’t choose my friends based on their credit scores. In fact, I couldn’t tell you a single credit score for a single friend or family member.

And, we supposedly are protected by federal law with is the Equal Credit Opportunity Act. It strictly regulates the criteria creditors can use when deciding on a loan. Right now, only things such as income, expenses, debts, and credit history determine whether you can get a loan.

A Mass Unfriending Ahead

Your friends do not—and should not—be part of that criteria.

The whole thing feels very discriminatory.

CNN Money quotes Greg McBride, chief financial analyst for Bankrate.com, as saying:

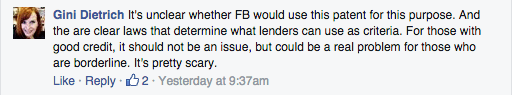

It’s nothing to lose sleep over for people with decent credit history, but it could potentially affect those who are borderline to begin with.

There are lots of reasons a person could have poor credit: A contentious divorce, one’s upbringing, student loan debt, or your debt outweighs your income because you teach or are in public service.

I have many friends—old and new—who fit some of this criteria. They don’t determine whether or not I’m a credit risk. How could they?

Am I supposed to just unfriend them now?

Give me a break.

The Facebook Patent Could Be a Revenue Generator

But Fortune tells a different story:

Using social media data isn’t exactly new—modern consumer lenders such as Affirm already take non-traditional data to estimate credit risk. Implementing this patent could help provide alternative lending, and it could also make it easier for predatory lenders to reach vulnerable people if the method described above is all that’s necessary for the loan.

While Affirm has a bad rap, it’s an interesting look at where this trend might be going.

Right now, we don’t know whether the new Facebook patent will be used to work with lenders.

We can hope it won’t happen.

If it does, if you have a high credit score, it’s time to start thinking about auctioning off your friends list.

“My credit score is 800. Want to get your loan approved? My friendship is yours for only $49.”

What do you think?